7 Questions on NAR’s S.M.A.R.T. Initiatives

The latest word out of National Association of REALTORS is that the Budget Committee, together with Leadership, has approved a new set of initiatives (not

The latest word out of National Association of REALTORS is that the Budget Committee, together with Leadership, has approved a new set of initiatives (not

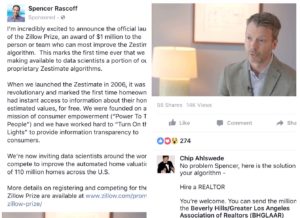

I recently amused myself – and a few others – when I Facebook trolled the CEO of Zillow, Spencer Rascoff for offering a million dollars

I recently amused myself – and a few others – when I Facebook trolled the CEO of Zillow, Spencer Rascoff for offering a million dollars

I’ve been traveling almost nonstop for a few weeks, so things have been light in the blogging department. My latest stop was Stefan Swanepoel’s T3 Summit

Blogging, social media, and work activities have been at an all time low. Big part of the reason is that the above is my view

This post, like every post in the month of October, is brought to you by our sponsor, Teardowns.com (and its subsidiary 2Elm), the winner of

This post, like every post in the month of October, is brought to you by our sponsor, Teardowns.com (and its subsidiary 2Elm), the winner of

The Council of Multiple Listing Services held its annual conference in Boise, ID this past week. In keeping with the high standards of excellence (which may be redundant,

My last post dealt at some length with Federal policy. But in many of my writings, presentations, and comments, I point out that the folks

Fill out the form below to download the document