Reader Ben Thompson asked me in a recent comment if I would opine on the topic of the impact of (and to, I would think) various companies in a buyer’s market:

Sorry to trend off topic, but Rob kindly please consider writing a blog post on the impact of companies like Redfin in a buyers market. You have hinted at the topic previously. Any chance you will consider a full blog post? The markets changing…. how does this impact Realogy, KW, Compass, eXp, Redfin, Zillow, Opendoor, Purplebricks? Who wins?

If I knew the answer, I feel certain that I would make a lot of money in the stock market. And would not tell any of you, obviously, because then you all would buy and sell too and move the market.

But opinions? I can do that. Opining and speculating and questioning are kind of what this blog is built on, after all. Plus, I just finished writing the August and September Red Dot reports, which forced me to research a bunch and read a lot of earnings reports. So I have some basis for these opinions.

The whole list of companies is, well, too long. Maybe that’s a full Red Dot on its own. But I can opine on Redfin and see if you guys think that’s useful.

So, without further ado, let’s get into it.

Set the Stage

To begin, let’s set the stage a bit. Because I don’t know that most people under the age of 50 today (which includes me) remembers what a “normal market” actually looks like. I mean, from say 2001 to 2007 we had the biggest real estate Bubble in history, followed by the collapse which almost broke the global financial system, followed by the strongest seller’s market in recent memory with home prices now above the peak of the Housing Bubble in 2006.

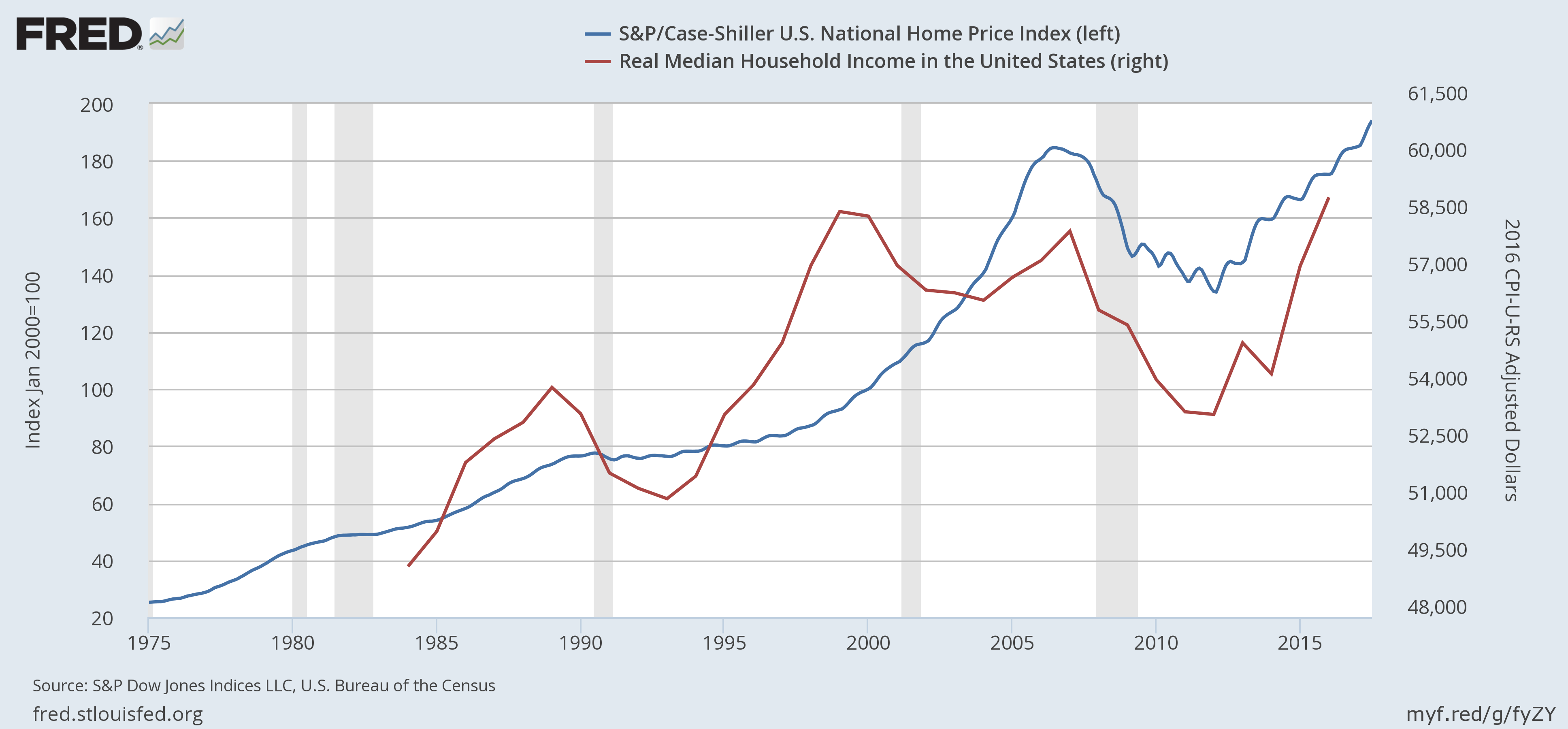

Of particular interest is this graph of the Case-Shiller Index vs. Median Household Income:

As you can see, median household income is barely back to 1998 levels, but home prices have never actually dropped below their 2003 levels. And median income has never caught up. So I just don’t know how far back we have to go to get to a “normal market” here. Certainly before I was in real estate, and maybe judging by the graph above, before I graduated college.

Now, it isn’t really clear what constitutes a “seller’s market” vs a “buyer’s market” except the dry and not entirely useful supply-and-demand thing: more supply than demand = buyer’s market, and less supply than demand = seller’s market. At least Redfin, the data darlings that they are, supply us with this definition:

An absorption rate above 20% is generally associated with a seller’s market, meaning that homes are selling fast. An absorption rate below 15% is generally associated with a buyer’s market, meaning that homes are selling relatively slowly.

So a “balanced market” would mean an absorption rate between 15% and 20% — seems like a pretty narrow band, but hey, what do I know? I’m not an economist or a data scientist. I’ll go with what the experts say.

Psychologically, real estate agents who were around for more than a few years remember the dark days of 2007-2012 or so. Homes sat on the market for months, sometimes years. Price drops were not only expected, you strategized around how and when and how much. You could hold an open house and see no one but a homeless guy looking for refreshments. Qualified buyers were the hot commodity and many a top agent who would have turned their noses up at having to drive buyers around were suddenly finding themselves unlocking lockboxes if they had a live buyer who could actually qualify for a mortgage.

Now, as I’ve said, I got started in real estate sometime in 2004 or so, which means I don’t know what a non-Bubble-collapse buyer’s market looks like. So in my mind, as I’m speculating, I am imagining something kinda like the situation in 2009/2010 but not quite as bad and not quite as nasty with far fewer foreclosures and REOs and all that fun stuff.

So, Redfin

Since Ben asked specifically about Redfin, let’s start there. Glenn Kelman is very fond of saying that “Redfin was born in the dark” as it was founded in 2004 but didn’t really get going until 2007 when they raised $12 million from Greylock Ventures and Draper Fisher Jurvetson. Then the market crashed.

DFJ partner Emily Melton tells that part of the story in her triumphant post-Redfin IPO recounting:

A housing market correction was forecast, yet the extent of the 2008 financial crisis caught us all by surprise. This was a challenging time for many startups, but as a startup real estate brokerage it was terrifying. Glenn often says, “Redfin was born in the dark,” but in reality, this is when Redfin shined brightest. Each obstacle was viewed by the team as an opportunity and every challenge was something to overcome. It was a difficult year, but failure was not an option. I saw passion, resilience, and a competitive drive that proved Redfin wasn’t simply a technology product.

And here’s Glenn Kelman from his IPO Diary:

To emphasize the frugality we learned in the 2008 housing crisis, we included in our investor video a cameo of the Batman villain Bane, who talked about being born in the dark. We described ourselves in the prospectus as “rabid squirrels.”

More recently, during his Q1 and Q2 earnings calls, Glenn continued to sound caution talking about how Redfin knew that the market would turn, and he didn’t want to make ginormous bets on things like Redfin Now without being far more certain.

Now, maybe Glenn and team didn’t feel blessed in 2008 – 2012 or so, but in retrospect that housing collapse came at just the right time… for Redfin. During the height of the Bubble — an insane seller’s market matched only by the insane seller’s markets we are seeing in some urban areas today — you barely had time to put your For Sale sign in the yard before you were getting multiple offers. Internet advertising of listings was just kinda getting going, but… who needed that when you could take a listing in the afternoon and have it sold with a phone call to a friend by that evening at 10% over list price?

When the market collapsed, all of a sudden, sellers wanted… no, needed to put their listing in front of every possible place a potential buyer could be lurking. I don’t think it’s crazy to believe that the reason why Redfin and Zillow and Trulia are so successful today is because they came around right when the market had collapsed and sellers (and their agents) were happy to put listings (which are, after all, advertisements of homes for sale) on every single website that would take them. Plus, buyers became so valuable that agents and brokers became willing to pay these websites quite a lot of money to get buyer leads in case one out of a hundred ended up being a bona fide qualified buyer.

So, what happens to Redfin if the market turns back to a buyer’s market? Why, they blow the %*#$ up. How could they not?

Why Redfin Blows Up (In a Good Way)

Let’s go over a few reasons why Redfin would grow in a scary kind of a way if the market turns.

Traffic

Redfin posted 28.8 million in average monthly unique visitors in Q2/2018 — a 17.9% YOY growth. I think it’s entirely possible that Redfin added more monthly uniques than Remax.com, ColdwellBanker.com, and Century21.com generated during that same period. (It’s speculation based on ratios and such, since those companies aren’t eager to trumpet just how far behind Redfin they are, but… if you’re really interested, let me know.)

Most website traffic is generated by buyers. We all know this, and Glenn said as much during his earnings calls. So if things turn to a buyer’s market, why, buyer traffic would just boom.

Redfin Will Flex

Some folks think Redfin is going to fall because of the success they’ve been seeing with their 1% Listing Fee program. It’s like they don’t even care to listen to Glenn:

And then I think we’ve tried to be clear that we’re not just going to talk about the market. We’re not a boat that goes up and down with the tides. We’ve got a sail, we’ve got a motor, we need to make our own headway.

He’s referring to comments he’s made over the quarters that Redfin has reduced some buyer rebates in order to offer the 1% Listing Fee. They can always adjust that mix so that revenues end up smoothing out. If things swing to something like what we saw in 2010, maybe Redfin goes to a 2% Listing Fee, and jacks up the buyer rebate so it picks up more of the buyer business.

They’ve got a sail and a motor and they’ll figure it out. But the flood of traffic they get on their own website gives them a massive lead generation advantage over everybody else not named Zillow.

Redfin Now is a Game Changer

I wrote extensively about this in the last two Red Dot reports, and you should want to go purchase them, so I’ll keep this part to a minimum.

Basically, Glenn revealed in the Q2 earnings call that Redfin is committing to Redfin Now because they have data that shows it works and is valuable to consumers. This thing is a game changer, but it’s likely to be even more impressive if we go into a buyer’s market. The psychology of the sellers has to be taken into account.

Sure, it’s easy to turn down Redfin Now (and Opendoor and Zillow and Offerpad and every other iBuyer) when you’re in a hot seller’s market and you feel like you’re leaving 10% on the table. It won’t be quite as easy to do if your home has been sitting on the market for three months with one showing and no offers, and you’ve already done two price reductions. (Or you hear that your neighbor is doing that, or your mother in law is having trouble selling her house….) Now that certainty of money on the barrel right now seems awfully attractive, doesn’t it?

And of course Redfin (like all other iBuyers) will just offer less, because they know that they’ll have to hold the home in inventory longer and merchandise it more. But if you bought your home in 2010 for $300K, and it’s now valued at $800K (not uncommon in some markets, yo), do you really feel like crap if you take Redfin’s offer at $600K?

More importantly, Redfin agents have a tool in their toolkit that other agents do not have (unless they have partnerships with guys like Zillow and Opendoor). And this isn’t a tool you can buy off the shelf from a vendor. Nor is it something that most brokerages are able to even dream about providing to their agents.

Redfin Jobs Are Going to be Primo

One thing I remember from the Bubble and the Collapse is just how fast formerly genius top producing agents and mortgage brokers suddenly became less than brilliant. Maybe it wasn’t their amazing marketing skills and deep knowledge of real estate that made them a fortune, but pure luck and a never-before-seen housing market.

I don’t know that we’ll see the same dynamic play out again, but… well… at the height of the Bubble in 2006 NAR had 1,357,732 dues-paying REALTOR members. In 2017, NAR had 1,308,616 members. At the end of July, NAR had 1,344,795 REALTOR members. About 13,000 more and we’ll have set a new record for NAR membership numbers.

Here’s the thing though. In 2006, there were 6.52 million homes sold, or 13.04 million transaction sides to be divided among 1,35,732 REALTOR members. In 2017, there were 5.51 million homes sold, or 11.02 million transaction sides. So we have just as many REALTORs today as we did in 2006, which we all recognize as the height of the Bubble, but 2 million fewer sides?

I should note that in 2012, NAR membership had dipped below 1 million: 999,824. More than a quarter of the REALTOR population dropped off the rolls, and one assumes, out of the industry altogether, from 2006 to 2012. A lot of them simply couldn’t make ends meet. They had to go get “real jobs” with a regular paycheck.

If that dynamic holds the next time we go into a buyer’s market, boy, that Redfin agent job is suddenly going to look mighty attractive to a whole lot of formerly top producing agents who today look down their noses at Redfin’s employee agents with their limits on earnings. “Unlimited earnings potential!” sounds fantastic, until you realize that the key word there is “potential”. It’s just another way to say, “You wake up unemployed every day.” Which is inspiring as hell in sales meetings, until you really wake up unemployed every day and nothing is closing and nothing is coming in.

Of course, these top producers have to be trainable… not have too many bad habits… and not be egomaniacs who can work in a structure with a boss and coworkers and such. Those are not traits often found among real estate agents, never mind top producing agents. The problem for them will be that Redfin doesn’t hire just any agent off the street because she’s a “top producer”. Redfin operates very, very differently from others and don’t look for the same kinds of traits and skills. Glenn Kelman has said that Redfin tends to find far more success by hiring people with sales and customer relationship skills from outside of the industry, then training them in the Redfin way with Redfin tools.

Nonetheless, I imagine at least a few agents will have the right mix of character traits, personalities, and work ethic to transition to a job at Redfin.

How Redfin Could Lose

Of course, success is never guaranteed. All sorts of things could happen between now and this buyer’s market future. Glenn Kelman could quit his job as CEO and decide to dedicate his life to increasing diversity in real estate and his replacement could be some incompetent dumbass. Maybe the entire Redfin leadership teams commits ritual seppuku out of despair when the Seattle Seahawks fail to make the playoffs. Governments federal and state could pass some laws that cripple Redfin; never underestimate the ability of politicians to ruin the economy. San Andreas could go from an action flick to a documentary (though that is far more likely to create an insane seller’s market….)

Short of such events, how does Redfin not blow up in a buyer’s market?

Short answer: Zillow.

Longer answer: A true Real Estate Platform emerges, and Redfin is not it. That takes away many of Redfin’s competitive advantages, and other brokerages — in a sharp departure from historical norms — learn to pivot quickly and effectively.

If you want more details, by all means, subscribe to the Red Dot.

Redfin’s Wins Will Come at Everybody Else’s Expense

One final note, since Ben asked about the impact of Redfin as well. I wrote in 2015 that real estate is a zero sum game:

So the clear implication is that everything in real estate is ultimately a zero sum game.

If an agent leverages technology, smart lead management, and topnotch service to increase production from selling 20 homes to 50 homes, then other agents in her market will be doing 30 fewer transactions. A broker making $100M more in revenues has to get that from somewhere — other brokers, from higher agent splits, somewhere. They don’t affect supply and demand; only macroeconomics does.

Similarly, if a vendor in the real estate industry becomes successful, that success must come from somewhere. It has to get a larger share of the Commission Pool, which necessarily means that someone else has to get a smaller share.

Well, not only would a dominant Redfin take market share from every other brokerage and agent team, it would put a serious hurtin’ on the real estate technology community. As far as I know, Redfin builds its own technology; spent $13 million doing just that in Q2 (that’s in three months, you guys).

So other brokers and agents will find their revenues and earnings plummet as Redfin just drinks their milkshakes, which means fewer agents and fewer brokers (see above re: NAR membership numbers from 2006 to 2012), but also means less of a need for IDX vendors, predictive analytics companies (Redfin does that already very well, thank you very much), CRM vendors, etc. etc.

Dismiss Redfin if you want. Their agents don’t know what they’re doing! It’s just a website! They have no presence in my market! It’s a free country, sort of, after all.

But Redfin was born in the dark, blew up like Biggie, grew up in the light, and they’ll be blowin’ up like I thought they would. And if you don’t know, now you know.

-rsh

21 thoughts on “When the Market Turns: Redfin”

Two things:

1) Website traffic doesn’t mean market share. Just ask the number of agents who close transactions where their Buyer’s preferred real estate app is Redfin. It’s like the real estate version of showrooming, except in reverse.

2) There is no normal. It’s all tied to the cost of money. Rates go up, prices will go down. Rates go down, prices will go up. Then we deal with the ensuing crash or bubble.

Absorption rates are merely the symptom, not the cause.

We know the market will turn. They always do. What we don’t know is what will be the underlying issues and the degree to which they affect rates and personal wealth, which would include loss of equity.

Redfin works well in an order taker market, but if we see a return to the loss of personal wealth and the resulting increase of underwater mortgages, a 1% listing fee isn’t going to be the reason why someone chooses Redfin.

Ask any seasoned pro and they dont fear a down market.

Mic drop.

Thanks for your thoughts, Bob. A couple of questions/points in response.

“1) Website traffic doesn’t mean market share. Just ask the number of agents who close transactions where their Buyer’s preferred real estate app is Redfin. It’s like the real estate version of showrooming, except in reverse.”

So how do you explain the fact that Redfin did $21.3 billion in Volume last year? And $7.9 billion in volume in Q2? That volume comes from 35,000 transactions in 2017, and 13,000 in Q2.

If Redfin’s site traffic is not responsible for that kind of volume, transactions, (and growth, by the way, which is in the 27% YOY range) then what is?

“Redfin works well in an order taker market, but if we see a return to the loss of personal wealth and the resulting increase of underwater mortgages, a 1% listing fee isn’t going to be the reason why someone chooses Redfin.”

So, when would you say was the last time we were not in an “order taker” market? Since Redfin was founded in 2004 and really got going in 2006/2007, but the Bubble was inflating from 1998 until the Crash in 2006/7… I’d just like to understand when the last non-“order taker” market was.

I don’t fear a down market but I do wonder if today’s homebuyers are willing to invest the time and energy into getting good help.

Redfin literally sends out their least-experienced agents and pays them $50 to open the door. Their buyers have been satisfied with that, apparently. I guess that’s all it takes in an order-taking environment.

The big agent teams have their newer agents on the front lines too, so it’s an industry-wide practice now.

Will homebuyers be more demanding about getting good advice from agents, or just stay on the fence once they realize how hard it is to find?

Where do I start?

Ok – let’s take Kelman’s metaphor first. Yes, Kelman has a sail and a motor, but he’s on a 16-foot runabout. The big boys have bigger boats with bigger motors suitable for going out in rougher seas. So much for that metaphor…

Let’s take their last two earnings calls and their March investor presentation – here

https://simonsaysrealestate.com/2018/08/15/realogy-and-redfin-the-q2-2018-earnings-calls/

and here

https://simonsaysrealestate.com/2018/05/14/realogy-and-redfin-the-earnings-calls/

Remember the part where Glenn said in the last call that they were not planning on hiring any new employee-agents for the ENTIRE third quarter?

Remember their misrepresentations/obfuscations on their March presentation slides (that’s in my second link)?

Unless things have changed dramatically for them in the past month, they are only doubling down on costly investments (mortgage lending software development) while trying to expand their Redfin Now program beyond Southern California. As Opendoor and all the other players in that space will tell you, it takes time to expand to new markets.

All this on a .83% market share as of June 30 for a technology-enabled broker? Bob Wilson nailed it – website traffic doesn’t translate all that well to market share. Buyers are one thing; prospective buyers and tire kickers are quite another.

Sorry, Rob. I’m not saying that Redfin is going to wither on the vine but it’s not going to become a force anytime soon except in isolated markets – buyer’s market or not.

Now if you want to talk about the big boys… 😉

Simon

I do so love the fact that someone else in real estate blogosphere is reading/listening to earnings calls 🙂 Thanks Simon. We might differ, but hey, that’s where I usually learn stuff. So a few thoughts/questions.

“Remember the part where Glenn said in the last call that they were not planning on hiring any new employee-agents for the ENTIRE third quarter?”

I didn’t read it that way. You quoted Glenn yourself:

“…our outlook on agent hiring is really affected by our outlook on the overall market. We’re not hiring agents this quarter to close sales this quarter or to close sales next quarter. All of our hiring is going to be about 2019, most of it will happen in the fourth quarter.”

To me, that “to close sales this quarter or next” piece is kind of important. That’s in line with what Glenn says every quarter — that they do the bulk of their hiring in Q4, to train the new agents up in time for the prime selling season in the next year. But that’s a minor point, no?

The real points you make are these:

“Unless things have changed dramatically for them in the past month, they are only doubling down on costly investments (mortgage lending software development) while trying to expand their Redfin Now program beyond Southern California. As Opendoor and all the other players in that space will tell you, it takes time to expand to new markets.

All this on a .83% market share as of June 30 for a technology-enabled broker? Bob Wilson nailed it – website traffic doesn’t translate all that well to market share. Buyers are one thing; prospective buyers and tire kickers are quite another.”

Let’s take those in order.

On the costly investments, well, time will tell whether those investments pay off or not. It isn’t as if every company on the planet makes costly investments in the hopes that they pay off in the future.

On expanding Redfin Now, yes, you’re right that it takes time to expand to new markets. We’ll see if Redfin manages it. But there are good reasons to think that they’ll manage it just fine. As Glenn says:

“Newer entrants don’t have the online audience we do, and pure websites don’t have as much operational expertise. We believe few companies have our spending discipline. This audience, field experience, and penny-pinching should let us acquire and sell homes at a lower cost, which will let us offer homeowners more money. For the person selling her home to Redfin Now that money is almost all that matters, and a war on price is the one we feel best prepared to win.”

I find it difficult to disagree with Glenn. Opendoor and others need more time to expand since they need to let consumers know they’re in operation in a new city; Redfin is already one of the top online destinations in markets where they operate. Zillow has to ramp up its operational skills; Redfin already has a lot of that in place. Feels like a “just add water (capital)” type of a situation to me. But how do you think of it?

As for the constant drum of 0.83% market share thing… I guess I understand? But as I said to Bob Wilson above, Redfin is still the #4 or #5 brokerage in the country by Volume and Transaction Sides. If Redfin’s website traffic isn’t responsible for $7.9 billion in volume, 13,000 transactions, and 27% YOY growth in Q2, then what is?

So who exactly are you pointing at as the counter-Redfin? Realogy? You trashed Realogy in your post. HomeServices? To the extent that HSA reports numbers at all through Berkshire Hathaway Energy, I haven’t found anything mindblowing — have you?

Finally, yes, I would love to talk about the “big boys”. Who in your mind are the “big boys”? 🙂

Ok, maybe I should have parsed Kelman’s words a little more closely on the agent hiring front. NO new agents hired during the third quarter would be a bit much, but I would still say that the number being hired during Q3 is going to be minimal. Combine that with some attrition and Glenn’s statement that they were requiring their current employee-agent to focus more on customer service and less on closing transactions, I’d say that it’s more than a minor point. But I’ll concede that one to you.

Costly investments? I’ll stand by that one, especially in light of the announcement that KW is buying Smarter Agent. Build as opposed to buy these days in this business is not only costly but risky compared to fifteen or twenty years ago when we didn’t have this plethora of real estate tech vendors. “Build” made more sense for the big brokers and franchisors back then. Today? I’m just not seeing it.

Expanding Redfin Now was not exactly a hard decision for them to make. My point here was that it will take time for them to show results just because the field has gotten crowded. Spending discipline matters as a publicly traded company but it will also slow down their growth rate in this area, so this becomes a complementary business line at best.

Do most of the other players last that long? I suspect not. Comparing Redfin to Zillow in the iBuyer space depends on what metrics we’re using. If we’re talking web traffic, Zillow wins hands down. If we’re talking available capital, Zillow wins. If we’re talking name recognition, Zillow still wins. I have never heard a seller complain about his or her listing not appearing on Redfin within 24 hours. Operational skills? I give you Zillow Concierge. Feels like “just add water” to me. 🙂

But as you and I have covered this topic before, Rob, comparing Zillow and Redfin is apples to oranges although I get the feeling that Zillow is starting to turn into a Mandarin…well, something else.

And that .83% market share? I had forgotten that the Redfin numbers do appear in the Swanepoel Mega 1000, but Redfin’s goal is not to be a regional player so that .83% market share does matter. A lot. And let’s not forget that as a pure play publicly traded company, everything is out there for investors to see unlike, say, Compass, Howard Hanna, Crye-Leike. And when it comes to available capital, I would throw Opendoor into the mix.

As for “trashing” Realogy, I’m just pointing out facts in evidence. Just as one should have (grudging?) admiration for what Zillow has accomplished, one has to shake one’s head watching Realogy the past few years. Home Services? Like you said, nothing mindblowing – they have the scale that Redfin would like to have but they aren’t immune to current events either.

And we know who the big boys are. It just depends on what part of the business we’re talking about. For now I would go with Realogy, Home Services, Weichert, Compass, and Hanna because I believe that it takes some “operational skills” to operate successfully across multiple states and metropolitan areas. For you, I’ll throw in Redfin.

But let’s continue that discussion. It’s always good comparing notes with you, Rob.

Hey Simon,

So cool to have an intelligent discussion and debate about industry things. 🙂

You wrote:

“Costly investments? I’ll stand by that one, especially in light of the announcement that KW is buying Smarter Agent. Build as opposed to buy these days in this business is not only costly but risky compared to fifteen or twenty years ago when we didn’t have this plethora of real estate tech vendors. “Build” made more sense for the big brokers and franchisors back then. Today? I’m just not seeing it.”

I’ll disagree with this. I think build is always better than buy, if you have the money and the time and the access to talent. Look at Redfin’s tech fortunes over the last 3 years compared to say Realogy’s. Realogy could try to spin the Zap Platform as much as they want, but I’m just not seeing it out there among the agents who are supposed to be using it. On the other hand, just about every single former Redfin agent I have ever spoken to talks about how much they miss the technology that Redfin had.

We’ll see if KW’s purchase of Smarter Agent pans out. I’m betting it doesn’t, but people have lost a lot of money betting against Gary Keller, so… take it for what it’s worth.

Also, you wrote:

“Expanding Redfin Now was not exactly a hard decision for them to make. My point here was that it will take time for them to show results just because the field has gotten crowded. Spending discipline matters as a publicly traded company but it will also slow down their growth rate in this area, so this becomes a complementary business line at best.”

I don’t know man… I spoke with Redfin folks for my August Red Dot on iBuyers, and… I think they’re rock solid. One thing that occurs to me is the idea that the field has gotten crowded might be oversold a touch. Maybe in low-hanging fruit cities like Phoenix and Atlanta, but Redfin was doing Redfin Now in Orange County. If Redfin expands Redfin Now into places where they have strong brokerage presence and others have not yet opened… they might see some real gains real quick. All depends on market conditions though, so who knows?

Finally:

“And we know who the big boys are. It just depends on what part of the business we’re talking about. For now I would go with Realogy, Home Services, Weichert, Compass, and Hanna because I believe that it takes some “operational skills” to operate successfully across multiple states and metropolitan areas. For you, I’ll throw in Redfin.”

Since Redfin is larger than Weichert and Compass by Volume and by Transactions… why are they the big boys and you’ll throw in Redfin for me? Don’t those guys have to prove that they are the big boys compared to the likes of Realogy, HSA and Redfin?

Plus, just like Redfin pales in comparison to Zillow in terms of web presence, those guys pale in comparison to Redfin. In a buyer’s market, when like 99% of buyers are going on the Web, how do they compete against Redfin? I’m not seeing it.

BTW, I thought you meant Amazon, Google, and Walmart when you said “big boys” 🙂

Great exchange!

-rsh

When people’s equity is decreasing every day due to falling prices I bet they will love Redfin’s 1% fee or others even lower fee because what they NET will matter even more so.

Good stuff here, a couple more thoughts:

1. Redfin, as a publicly traded company, has to answer to shareholders, and that becomes even more of a time suck in a market downturn. The money the company is (now wisely) investing could evaporate as their share price tanks, forcing layoffs, reduced capital expenditures, etc. It’s a crux of going public: the leash for risk taking is considerably shorter when markets suck, and companies that can play the other side of the coin (i.e. Zillow) may be able to swoop in and grab more market share.

2. Redfin’s reputation is agnostic to the market environment, and it’s not a pretty one (whether your a pro or a consumer). Its image to most is cheap, quantity > quality, and a great place to search for a home, likely lousy way to buy it. There is always an audience where saving 1-2% on the transaction is more important than a quality agent, but I’d argue that that actually becomes less important during a downturn, and instead, finding a well qualified, emotionally intelligent agent is valued at a premium.

Thinking from my background in finance, few in 2008ish wanted cheap advice or a noob advisor. Even when things have been good the last 7 years, Redfin hasn’t run away with the market (or turned a profit last time I looked), so I question how strong their value prop is when the market changes.

Thanks for your thoughts. I do have a question on this:

“2. Redfin’s reputation is agnostic to the market environment, and it’s not a pretty one (whether your a pro or a consumer). Its image to most is cheap, quantity > quality, and a great place to search for a home, likely lousy way to buy it. There is always an audience where saving 1-2% on the transaction is more important than a quality agent, but I’d argue that that actually becomes less important during a downturn, and instead, finding a well qualified, emotionally intelligent agent is valued at a premium.”

Do you have a source for this poor reputation/image of Redfin? I know that brokers and agents have a low opinion of Redfin, but you specifically said consumer. So that has to mean some kind of survey, study, whatever. The only such surveys I’ve seen are from Redfin itself (so we can suspect that) but those are glowing in favor of Redfin. NPS scores are way, way above the industry norm, for example.

So are your claims based on any third-party source, or just a general impression/sense of Redfin based on anecdotal evidence? (The latter can be valid, but I’d just like to know.)

Also, you said:

“There is always an audience where saving 1-2% on the transaction is more important than a quality agent, but I’d argue that that actually becomes less important during a downturn, and instead, finding a well qualified, emotionally intelligent agent is valued at a premium.”

Are you saying that during the last downturn (2007-2013 or so), consumers placed premium value on finding a well qualified, emotionally intelligent agent? Because that’s precisely the same timeframe during which Redfin and Zillow and Trulia blew up. And I’ve been told time and again that the problem with all three is that consumers are sent to whoever pays the website, not to the best qualified agent. How do you square that circle?

When naysayers mention about poor customer service from Redfin, I chuckle. Just think about it Rob- Redfin sends out a survey to EVERY client after a transaction whether it closes or not. That survey is posted publicly on the agent profiles page and the general public can read them all. Bonuses are based on these customer satisfaction scores. Does ANY other brokerage do this? They like to post testimonials on their website, nobody sends out a survey and if its a poor response willingly posts in on their consumer facing site. And when redfin agents overwhelmingly have positive survey responses (I would guess 90% + score), they must be doing something right and their customers are definitely liking them, so all this poor customer service talk from naysayers are useless.

This is the agent profile page of a friend and a former coworker (I used to work at redfin). Take a look at the surveys, Its all 4 or 5 stars and there is one 1 star survey five years ago. That is still there after all these years and they have not taken it down because if they take it down, then all their talk about transparency and customer advocacy is just manufactured and

bullshit. https://www.redfin.com/real-estate-agents/courtney-rice

Sorry, Rob for the delay…

(A quick note on the response below – I think surveys are bullshit, because generally only those on the extremes tend to respond. So I guess it’s good Redfin has more super happy (would love to respond positively!) types, I don’t care, their business model is built specifically for low-mid market transactions and quantity > quality).

I do not have hard evidence, only anecdotal with conversations of dozens of real estate agents, reading publications, hell even Reddit users post a lot of, what I’ll call ‘real’ reviews (again, generally only the angry have enough energy to post it on Reddit).

Secondly, regarding market dynamics, this comes from my background in finance. During the crises, folks leaned much more heavily on the gray-bearded and battled tested advisors and analysts, placing prior experience above saving cash (ironically enough, as account balances bled). For real estate, the transactions are much less frequently, so there’s significantly less brand loyalty and advisement that occurs, so perhaps in rethinking, the % of people who care about savings some dollars is probably higher (than quality advice).

The birth of portals during that time was due to so many factors: agents simply leaving the market, the technology maturing, the timing being incredibly favorable to portals marketing message, etc. I find it hard to square up the tanking of the real estate market with the rise of portals (would see it the other way around).

It’s more likely the value of the company (in the eyes of Wall Street) was seen as a white knight to the industry (screw these greedy agents! let’s displace them! Zillow is going to do it! — > stock soars) – we’ve seen this not to be the case, but the value of Zillow has continued to rise because of their ability to monetize agents, not displace them.

The time for Redfin is critical to create the best value and wealth from their IPO.

Many good real estate companies that were successful before the market crashed in 2007 or 2008 do not exist anymore. The biggest issue with Redfin wealth creation is that, only a small percentage of companies like them who went IPO, did not create any wealth for their investors, and often nothing more than a return on capital. When Redfin decided to offer shares to anyone through a public offering, it will receive most of the proceeds from the sale of Redfin. Existing shareholders gain a more liquid market to sell, and even if the stock price drops from the IPO, these investors will likely receive more than they paid and will look to sell Redfin.

Redfin`s business model can not create a profit. There are no miracles with this business model.

It is safe to say that Redfin’s effort to fundamentally disrupt the real estate industry hasn’t come to fruition. The company’s market share is around two percent in markets where Redfin has been operating for more than a decade.

Redfin`s stock is worth less than Zillow. Redfin is worth around $2.0 billion, while Zillow, founded two years after Redfin, is worth $9 billion after acquiring Trulia in 2015.

Redfin has slashed its rebates. In 2007, buying a $500,000 home through Redfin got you a rebate around $10,000. Today, the same home comes with a rebate of only $2,500. Redfin takes the other $12,500 of the three percent buyer side commission.Even with this extra revenue, Redfin has yet to turn a yearly profit.

Redfin has entered many new markets in the last two years, and as a result, its revenue more than doubled, but still no profit.One of our law firm clients had the experience of buying a home through Redfin.She said. “it is not dramatically different from the experience of using a traditional agent”.

So, the main question here, does the consumer see any differences buying a home using Redfin? My answer is: NO!

My conclusion is: it is almost impossible to disrupt the real estate industry while you must play by the rules and regulations that NAR is dictating. Only an outsider who does not need to play by the rules and regulations NAR is dictating, can disrupt this industry.

FYI, Redfin’s market share in its oldest market Seattle is closer to 7%.

Rob – this is (IMO) among the best articles you’ve written, and my personal favorite.

This stood out to me the most:

“…is just how fast formerly genius top producing agents and mortgage brokers suddenly became less than brilliant. Maybe it wasn’t their amazing marketing skills and deep knowledge of real estate that made them a fortune, but pure luck and a never-before-seen housing market.”

YES!!… appreciate & leverage what you have, but plan for when you don’t. (and it will happen again)

The time to plan ahead for the next major downturn, is when you’re climbing out of the trough.

I must echo Tony Gilbert’s statement. You have written quite a few phenomenal articles, but this one is definitely up there! Just Awesome!

You know you are a fan of someone’s writing that when they quote past articles from years ago, you can recall them near verbatim.

If feels like the number of pivots in the real estate tech industry has exponentially increased since Redfin’s IPO 13 months ago. I believe Glen Kelman decided early on to build Redfin into the most efficient consumer centric real estate brokerage possible. He built the business playing the long game. It was constructed backwards with the consumer constantly kept in mind.

While reading your fantastic post I couldn’t help but to think about Mike Delprete’s article “Built Not to Last”. He states: “Imagine a business founded with an end date. After two years, the stakeholders come together, ask what the company would look like if they founded it today, and then form that company. The new business retains the good elements, sheds the bad, and moves forward with a fully-committed team.” I see Redfin as a company that keeps evolving & GK never seems satisfied with the status quo.

Thank you kindly for providing your incredible insight! I can’t wait to see how this all plays out over the next 4-5 years and longer.

You’re the best Rob!

Aww, thank you both 🙂

Rob –

Have you ever considered writing for seekingalpha.com? This posts & many others you have written would be very well received.

Just a thought! Thanks for the great post.

-Amanda

Thank you Amanda. I hadn’t thought of writing for SeekingAlpha or any other investor-focused site because I don’t really analyze these companies as investments. I think I’ve said when I first talked about Redfin that I have no opinion on whether they should be given a tech multiple or a brokerage multiple.

But maybe those guys would come over here and read stuff they find interesting for their investment theses. 🙂

Comments are closed.