Okay, it turns out that Part 2 was the difficult one to write, because of how complicated organized real estate is. Part 1, the impact on brokerage, is here in case you missed it.

The final question is the impact on technology vendors in real estate. They are actually a pretty important part of the industry, after all. If you’ve already read Part 1, then you know the general direction of this thought experiment already.

In any event, let’s get into it.

We’re Not Talking About Websites

First of all, we’re not talking about the various website vendors, like Placester and Real Estate Webmasters or whoever else. Because website vendors will continue to thrive, at least until the number of brokers and agents drop below a threshold. It isn’t as if the advent of portals like Realtor.com and Zillow and Trulia stopped individual agents and brokers from setting up their own websites.

In 2017, you pretty much have to have a website, just like you need a business card. I know I’ve chosen vendors (plumbers, exterminators, accountants, etc.) based on their websites. I imagine it won’t be much different for real estate agents.

So the website vendors will be fine, even if the traffic to said websites dwindle. (And they might not! The consumer demand for information is insatiable.)

We’re talking about productivity technology vendors. CRM, transaction management, lead management, marketing, etc. etc.

Those folks got problems.

Redfin Has Technology

In earlier posts, we went over Redfin’s technology advantage (coupled to their employee model) over other brokerages and agent teams.

But let’s revisit this by quoting extensively from Redfin’s S-1. The following is listed under a section entitled “How We Win“:

Next-Generation Technologies

From stocks to books to lodging, technology has made it easier, faster, and less expensive to buy almost everything in our lives except the most important thing: our home.

To solve this problem, Redfin uses a wide range of next-generation technologies. We invented map-based real estate search. We use machine learning and artificial intelligence to answer customers’ most important questions about where to live, how much a home is worth, and when to move. We draw on cloud computing to perform computationally intensive comparisons of homes at a scale that would otherwise be cost prohibitive. We use streaming technologies to quickly notify customers about a listing. And we embrace new hardware, such as three-dimensional scanning cameras that let potential homebuyers walk through the property online.

Now, to be fair, there are a whole lot of vendors in real estate who claim the same — machine learning, artificial intelligence, cloud computing, etc. Check out my friend Andrew Flachner’s company, Realscout, for example. Or take a look at guys like Remine and Smartzip, who are talking predictive analytics and big data. And the 3-D camera technology isn’t Redfin’s; that’s Matterport, which other brokers and agents have been using forever.

Then again… we have these brief descriptions under “Machine Learning”:

Redfin Listing Recommendations

Knowing which listings customers visit online, tour in person, or ultimately make an offer on lets our algorithms make better listing recommendations, further enhanced through curation by our lead agents. These Redfin listing recommendations are one part of our strategy to increase the revenue generated from online visitors by personalizing our website and our service to keep customers engaged with Redfin from their first visit to a closing.

Redfin Estimate

Our access to detailed data about every MLS listing in markets we serve has helped us build what we believe is the most accurate automated home-valuation tool. According to a 2017 study we commissioned, among industry-leading websites that display valuations for active listings, 64% of the listings for which we provided a public valuation estimate sold within 3% of that estimate, compared to only 29% and 16% of the public estimates for the two other websites in the study. Our proprietary Redfin Estimate is fundamental technology that draws visitors to our website, then entices them to subscribe to a monthly home report with updates on changes to their home’s value. Views of off-market homes on our website in 2016 grew 78% year-over-year. We believe this increase is due in large part to the Redfin Estimate. The Redfin Estimate supports our sellers’ agents in consultations with homeowners, our buyers’ agents in guiding buyers on what to pay for a home, and our marketing teams in deciding which homeowners to target for a listing consultation.

Redfin Hot Homes

This proprietary algorithm identifies the homes we believe are most likely to sell quickly. Coupling Redfin Hot Homes alerts with on-demand tours, as well as data we’re collecting about offer deadlines, is part of our strategy to give our customers a first-mover advantage in pursuing the most desirable homes for sale.

We believe that our approach to data science and machine learning will continue to yield other insights, about the customers most likely to complete a transaction, about the key moments for offering service to online visitors we hope to convert into customers, and even about which homes will be harder or easier to sell, so we can optimize our fees and set customer expectations. [Emphasis added]

Huh. That’s… different. Although, I’m sure there are vendors who can provide similar technology to brokers and agents, aren’t there? I mean, The Realty Alliance brokers were pretty hot and heavy for broker AVM’s back in 2014? Presumably, those guys have the same kind of capability that Redfin has with the Redfin Estimate.

Plus, smart guys and gals in real estate tech are hard at work doing things like Listing Recommendations and and Hot Homes alerts, then combining that with services like Centralized Showing Services, aren’t they?

But then again…

Redfin Agent Tools

Because customers use our website and mobile application for their home search, and often go online to schedule tours, ask questions, review traffic to their listing, or start offers, we do not depend, as many competing brokerages do, on agents manually logging every customer interaction. Our proprietary Redfin Agent Tools automatically captures information on millions of customer interactions every year, and provides templates for our lead agents to recommend listings, follow up on tours, prepare comparative market analyses, and write offers. Our employee agents can access Redfin Agent Tools on their mobile device, so we can serve customers better and faster, even when our agents are in the field rather than at their desks. This is why a Redfin team can work together to deliver personal service to a large number of customers, with an agent using the system to learn, for example, that one customer is only interested in homes without stairs and another customer is looking for a home near a bus route. [Emphasis added]

Yeah, well, that data entry problem is a tricky one for traditional brokerages to solve, isn’t it? And that’s one problem that technology vendors have a bit of difficulty solving as well: how to get the data you need for your fancy algorithms to do their groove thang?

So look, Redfin has the technology. No one really debates that. What they do debate is whether that advantage is a big one or a small one.

Imitation Is the Sincerest Form of Flattery

I spoke with a friend of mine who is the CEO of a real estate technology company. I won’t use his name (unless he reads this and outs himself) because this industry… you know… omerta and such.

His take on the whole Redfin technology thing is that it’s no big deal, because he can copy whatever Redfin does and get that to market at a fraction of the cost that Redfin spent to develop it in the first place. So Redfin gets to spend tens of millions developing something, trying it out, and if it works, others will copy it and release it to the rest of the industry within months, if not weeks.

There’s quite a bit of logic in that. I mean, reverse engineering then cloning is something that the Chinese economy, for example, is based on.

I do wonder, though, whether such reverse engineering is all that easy to do. I mean, Chinese government demands the source code for Western technology companies that want to do business there for a reason. Seeing what’s on the outside doesn’t necessarily mean you see what’s on the inside, right?

So say Redfin launches some newfangled tool that consumers just love. We can see how it works as a consumer might, then try to reason out how Redfin did it, then duplicate the features. But unless you see the source code, it might not work the same, or have unexpected bugs, or who-knows-what-else.

And working all of that out takes time and money. Do real estate tech vendors have time and money?

Nimble Only Gets You So Far

In various presentations, I talk about the issue of money and technology, and I like to say, “Money isn’t everything in technology… but money isn’t nothing either.”

If money were everything, we’d never have startups — two guys in a garage, working day and night, coming up with something the big guys haven’t thought of. But if money were nothing, Facebook wouldn’t have a gigantic office building and 17,000+ employees worldwide.

Money in technology does two things for you.

One, it gets you the best talent. Sure, you have entrepreneurs who get offers to go work at Google or at Zillow who say no, because they have a dream and a vision and founder’s shares in a company that could make them millions. But their programmers? Those guys can be recruited by dangling a big fat paycheck and a bunch of stock options in front of them.

Consider this: say you’re a real estate tech company CEO. You have a star programmer, a 22-yr old who is a whiz at iOS apps. If she’s really that amazing, wouldn’t Redfin or Zillow come calling? For that matter, screw Redfin and Zillow, two never-made-a-dime companies. Wouldn’t Google and Amazon come calling?

Two, it gets you more bodies to throw at problems. That’s not as big a deal when we’re talking about senior technology people who create new stuff. It is a bigger deal when we’re talking about QA, beta testing, bug stomping, minor database fixes, and so on. But all that grunt work is what differentiates great software from so-so software. And in today’s world, so-so gets it rough.

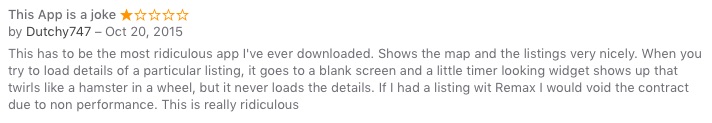

Check out these comments, for example:

“This has to be the most ridiculous app I’ve ever downloaded. Shows the map and the listings very nicely. When you try to load details of a particular listing, it goes to a blank screen and a little timer looking widget shows up that twirls like a hamster in a wheel, but it never loads the details. If I had a listing with Remax I would void the contract due to non performance. This is really ridiculous.”

That’s for the Re/Max App in the iTunes AppStore.

Then we have this:

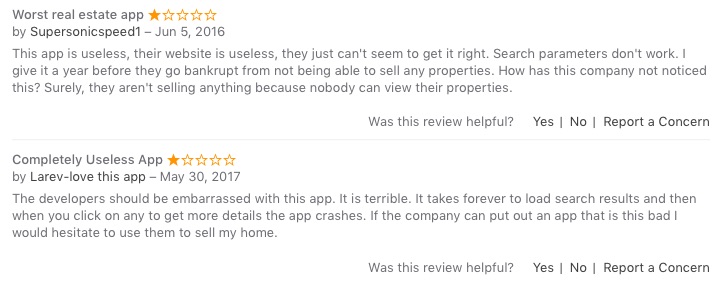

“This app is useless, their website is useless, they just can’t seem to get it right. Search parameters don’t work. I give it a year before they go bankrupt from not being able to sell any properties. How has this company not noticed this? Surely, they aren’t selling anything because nobody can view their properties.”

“The developers should be embarrassed with this app. it is terrible. It takes forever to load search results and then when you click on any to get more details the app crashes. If the company can put out an app that is this bad I would hesitate to use them to sell my home.”

Those would be for the Coldwell Banker App in the iTunes AppStore. (Might I suggest pulling that app off of iTunes? It’s hurting your brand and your company… I think there’s a newer version from ZapLabs that is unrated….)

Then compare those comments to the Ratings & Reviews on Redfin’s mobile app (current version, 4.5 stars).

These are major national franchises that are presumably spending a good amount of money to get a mobile app. But they’re not spending Redfin money, and the result is as above.

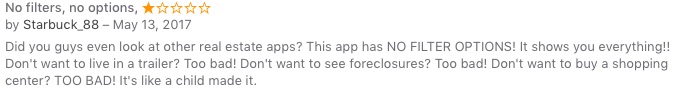

If you want a cringe-yet-laughter inducing experience, go check out the Ratings & Reviews on mobile apps of individual brokerages, even big ones. My favorite comes from Weichert’s mobile app:

“Did you guys even look at other real estate apps? This app has NO FILTER OPTIONS! It shows you everything!! Don’t want to live in a trailer? Too bad! Don’t want to see foreclosures? Too bad! Don’t want to buy a shopping center? TOO BAD! It’s like a child made it.”

Anyhow….

My point is that while real estate tech vendors could copy whatever Redfin does, there are some issues to think about, unless you’re spending Redfin kind of money on technology ($35 million a year, pre-IPO). QA, testing, and bug fixes are but three of those issues.

It’s not like the app developers for Weichert didn’t look at other real estate apps, right? They did, then tried to copy cool and interesting features. It just… didn’t quite work out how they imagined.

And as far as I know, there are maybe five real estate technology companies that could or are spending $35 million a year on technology: Zillow, Move, Opendoor and… maybe Homes.com? Compass? (One hopes it isn’t Re/Max and Coldwell Banker.)

Then There’s Integration…

The other major problem of real estate tech vendors is that they usually focus on one area. For example, Contactually is a highly regarded CRM provider. People who use it say it’s fantastic.

The problem? Contactually is only a CRM. It has to be integrated into all of the other systems and tools that a brokerage has.

Docusign is great for e-signatures, and offers a transaction management add-on. But it doesn’t do CRM work, or website lead generation work, or CMA work, or… you get the idea.

What Redfin has built is an end-to-end, vertically and horizontally integrated brokerage technology system that spans from the consumer website to the Agent Tool on the Redfin agent’s iPhone, integrating the full suite of data analytics, recommendation engines, customer satisfaction, etc. etc.

To compete, everyone else is going to need the same thing. But they need to cobble it together with products from several different vendors.

That ain’t easy. Despite RESO plugging away at data standards for years and years, it isn’t as if we have a plug-and-play world in real estate technology today.

Not to Mention Fragmentation…

And that’s without the final nail in the coffin: agents in brokerages have their own goddamn systems!

This is the one major, not-solvable-by-tech-companies problem that they face.

Because agents in traditional brokerages are 1099 independent contractors, the brokerage cannot require that they use the broker’s software system. Accordingly, even if the brokerage (or the franchise) invests $50 million in an end-to-end solution, the agent has to agree to use it voluntarily.

More often than not, agents have their own vendors, their own tools, their own systems, and don’t want to use whatever it is that the brokerage/franchise provides. Hell, Boomtown wouldn’t exist today if agents didn’t buy their own technology.

So not only does the tech vendor have to integrate horizontally with other tools and systems the brokerage wants, it has to integrate with all of the tools and systems of all of the agents in that brokerage? Then QA and bugfix all of those integrations?

Good luck with that!

Meanwhile, Redfin introduces another innovative product you have to try and copy, but you’re not done integrating the last copycat product.

You’re gonna need more money.

Speculation Time!

Given all of that, what happens to real estate technology vendors?

See, Zillow was laser-focused on its core bread-and-butter: website, leads, and converting them. They bought Trulia, then immediately sold off Market Leader, because they don’t want to be in that business. Sure, they bought companies like Bridge and Retsly because they want to befriend the MLS and big brokers to ensure that they have access to listings. But Zillow has never been in the end-to-end fully integrated brokerage operations technology business.

Redfin is.

In a 2014 post, Glenn Kelman quotes Chris Dixon of Andreesen Horowitz, a venture capitalist that backed Facebook and AirBnB among others, who said in an interview:

The full-stack approach lets you… completely control the customer experience, and capture a greater portion of the economic benefits you provide.

The challenge with the full-stack approach is you need to get good at many different things: software, hardware, design, consumer marketing, supply chain management, sales, partnerships, regulation… The good news is that if you can pull this off, it is very hard for competitors to replicate so many interlocking pieces.

Glenn then follows up with:

This vertically integrated approach, with real estate software working hand in hand with real estate agents, once seemed hopelessly antiquated. It takes more time and money to build, expanding one neighborhood at a time.

What vendor in the real estate space today can offer the traditional brokerage (or for that matter, the non-traditional brokerage) this full-stack end-to-end technology platform?

I can’t think of one offhand, but if you can, let us know in the comments.

So what I see, then, is a massive wave of consolidation among the tech vendor space. The larger, venture-backed companies had better start working on a new business plan to pitch to their investors, saying, “We’re gonna need another $100 million to acquire a whole bunch of companies.”

Companies like Placester, which has raised $100 million to date, and acquired smaller companies like RealSatisfied, might have to acquire a bunch more companies in CRM, transaction management, data analytics, etc. etc. to be that provider. Maybe a bunch of smaller guys merge together to try to create that full-stack technology company.

Maybe the big guys, like Fidelity and Black Knight, go on an acquisitions spree. Fidelity did buy Commissions Inc. in 2016 for $250 million or so, according to Inman. And then a few months later, bought Tiger Leads from Move.

If you specialize in a particular area — like say predictive analytics — grow market share at all cost. Because somebody is likely to come knocking on your door with a big fat check.

It’s also possible that Redfin forces Zillow and Move to get back into businesses they just left, because of broker demand. I’ve already written that many brokers will get woke and realize that Redfin threatens them way more than Zillow ever did. So they go to Zillow and say something like, “OK, so you’re not the devil, and even if you are, I’ll make a deal with you. I’ll send you all the listings, pay you for advertising, and all that jazz. But you gotta give me something more than just leads; you gotta give me the full-stack technology that lets me compete with Redfin.”

That sound you hear is the sound of Spencer Rascoff cracking open the checkbook to acquire companies and talent to put that end-to-end solution together for brokerages.

Maybe Dotloop becomes Dotloopier as a result. /shrug

Systems Integrators?

The other possibility, or a parallel development, is the rise of systems integrators in real estate.

These are companies that don’t produce any software or technology of their own; they just integrate software systems to make them work for a client. CSC and Accenture are two of the largest.

These companies specialize in making separate sub-systems work together as a whole for a company. So in retail, for example, you have one software that handles all of the logistics (warehouses, distribution, ordering from suppliers, etc.) and another that handles point-of-sale terminals and another that handles HR and yet another that handles corporate accounting and so on and so forth. Well, they all have to talk to each other and work together so the company can do its thing.

Maybe we see the rise of systems integrators in real estate. Companies that don’t produce a CRM, or a transaction management system, or a website, but know how to stitch them all together so they work as a whole full-stack end-to-end solution.

The brokerages have to solve the agent adoption and fragmentation problems, but if they do, maybe systems integrators can put together a complete system from a few, several, dozen, more (?) subsystems.

That might be a business opportunity for some smart IT folks.

Hooray for Chaos and Change!

We’re over 3,000 words in. Might as well stop here. It isn’t as if we’re never going to talk about real estate technology again.

So what can we say about Redfin’s impact on the technology vendor space?

Well, since Redfin has built and will continue to perfect its full-stack end-to-end solution that isn’t just technology but a blend of technology and business model, there’s going to be some chaos and change.

Brokerages will have to think about having their own end-to-end system, instead of a hodge-podge of silo’ed tools and a dizzying array of tools that their agents use. But if they have figured that out, the tech companies still need to provide that end-to-end solution.

That means either (a) a wave of consolidation, cuz money does mean something in technology, (b) big guys going on acquisition binges, (c) the rise of systems integrators in real estate, or (d) all of the above.

I’m going with (d) all of the above because people are smart and will try different things. And that’s good for the industry. We’ve needed something to spur on innovation and new thinking for a while, and nothing quite focuses the mind as much as the prospect of imminent doom.

It’ll be interesting times, that’s for sure.

-rsh

5 thoughts on “The Impact of Redfin Post-IPO: Part 3 — Technology Vendors”

So I think I get it. Technology is an enabler and it has the potential to do interesting things “automagically.” But it’s not like Redfin is unique with this capability. ZipRealty did the same thing albeit in a different generation of tech. But to their investors credit, at least they knew that “when the horse died, to get off.” Not sure that company was even worth the $167MM or so paid for it, but the promise was that its tech could evolve the dusty old brands at Realogy into something more. Did that actually occur? Not sure, but based upon what I see in the market as a result, I would say not really. The key to at least real estate tech is to be able for the brokers and the agents to readily “plug and play.” Why? Because tech evolves and owning tech is not a good business for every industry player. In the free world of brokerage, companies like MoxiWorks now offer brokers a platform that has pre-integrated more than 40 different tech providers into one fully integrated place. Plug a CRM in, a TMS in and a CMA presentation in and go! And as it relates to value, that is 100% dependent on the leadership of the brokerage company to be able to apply the technology in an effort to universally (within their companies) improve the overall consumer real estate experience. At the end of the day success in brokerage is measured by the consumer’s adoption and agent’s acceptance of the broker’s offering. And to date, Redfin’s marketshare “climb” by applying all of its technology and strategy still has there company waiting for better weather at the “base camp” of the industry.

If a vendor thinks they can just copy great tech and be competitive that is short sided. Even with cash on your side (BPP and AMP/UpStream) bringing product to market is easier said then done. We can all cheaply buy “replicas” of Facebook, Uber, Snap and Instagram but we don’t because it would cost us 50M in marketing to compete. The reason China can be successful with copying is largely due to forced adoption aka internet censorship.

I think even if you do create a competitive or even better tech stack then Redfin you’ll still be at a disadvantage until Brokers start forcing their agents to follow a defined process. Agents are notorious for not only wifing on a slow pitches but failing to step up to the plate in the first place.

You see it time and time again when a great vendor has a site license with an MLS and everyone is celebrating because they have 15% adoption (if that). Agents don’t use great technology even when its FREE. And lets not even bring up how terrible agents are at responding to leads – paychecks are calling and an agent can’t be bothered to call them back in a timely manner because they’re busy with something else thats not supporting their bottom line. I’d love to see the percentage of leads that aren’t contacted when submitted to Redfin. I bet its hovering around 0%.

Until you can force an agent to follow a process it doesn’t matter what Zillow, Move, Realogy, Brokers or Jesus himself bestows upon the agent community. Nothing will save them.

Rob a question. Generally speaking Uber made anyone with a car a fantastic transportation experience compared to a taxi driver who has decades of experience. Redfin helps agents, even newbies, outperform their peers by leaps and bounds. We keep speculating on how the legacy industry responds to Refin, Opendoor, and Zillow but can you name any other industry that has ever successfully rose to the occasion? I cant.

Hi Anon,

Now that you mention it, I can’t think of any other industry that rose to the challenge of tech-enabled disruptors. The only company I can think of is Southwest Airlines, but in truth, Southwest is kind of the Redfin of airlines, no?

Interesting question.

Nope. Although a newcomer to the industry I think Elon will reintroduce automobiles as the preferred method of regional travel with Boring and Hyperloop. Maybe someone creates a traditional take on the brokerage that invigorates the consumer but they will be from the outside.

I don’t think anyone can make air travel great. You could fly people around in champagne bars that included shoulder massages and live concerts performed by Billy Joel. The process of navigating the airport still ruins the experience.

>I’d love to see the percentage of leads that aren’t contacted when submitted to Redfin. I bet its hovering around 0%.

Good point, there is a “support agent” or a team of support agents in every market whose only job from 8 AM-10PM is to work with incoming leads/customer queries, qualify them and if they want to go on a home tour or book a listing consult, the support agent then immedietely puts it on a lead agent’s calendar. This is the support system they have in place to help the lead agent who does not have to deal with tons of those incoming queries while they are out in the field working with their active customers.

Comments are closed.