I’ve been really, really busy traveling all over this great country of ours. Finally got to visit Montana which is every bit as beautiful as advertised… I think… since most of what I saw was snow blinding my windshield…. But the view from the plane coming in and flying out was exquisite. Must visit again soon.

In any event, I’ve gotten several requests from readers (and from the writer!) about Opendoor’s big funding raise. Teke Wiggins from Inman did a great job of covering it here; read the whole thing.

Teke’s take is that there are ten ways that Opendoor with this huge capital infusion would impact the industry:

- Expansion into more markets

- New opportunities for agents, through the “partner agent” program and others

- New competition for agents, especially on the listing side, since Opendoor is a broker with in-house listing agents in Phoenix and Dallas.

- Lower fees (though the story makes it seem like that’s not a big focus)

- Imitators, cuz the smell of money attracts competition

- More showings without agents, because Opendoor uses keyless-access technology

- Growth of home-sale guarantees

- Streamline underwriting

- More mortgage financing by private equity and hedge funds

- Simplified title services

That’s a pretty comprehensive list. And people are commenting on Opendoor, of course, and brokers and agents being brokers and agents, the comments are like this:

What I would like to know is how they can get the math to work. They are telling the world that their “service fee” is 6-12%. As a seller, if the fee is only 6%, this works in their favor since they won’t have a Realtor fee, so they lose nothing if they were planning to pay 6% brokerage fees anyway.

They are, in my humble opinion, missing the forest for the trees.

Even industry pundits, like my buddy Greg Robertson over at Vendor Alley, kinda-sorta sees it… but then doesn’t:

To me Opendoor is more akin to CarMax. I recently sold on older car through CarMax, I didn’t get as much as I would have wanted but the process was pretty much hassle free, and to me, time is money.

The rub here is that some in Silicon Valley have thought real estate agents would be replaced by software by now, just like travel agents.

But many of these new entrants have failed to grasp the emotional nuance of buying and selling real estate.

I think everyone is missing the big picture here. And since many of you have asked for my take, here it is (although it will come as no surprise to regular readers).

I don’t think Opendoor cares all that much about real estate brokerage; this is a play to revolutionize mortgage financing. Let’s get into it.

My Thoughts on Opendoor the Past Two Years

I’ve written about Opendoor in the past couple of years, ever since I heard about this new startup by Keith Rabois, who is Silicon Valley royalty. My first take on Opendoor back in 2014 was this:

I’d imagine that Opendoor — knowing that its AVM’s have an error rate — would probably bid under what the AVM says the property is worth. Every offer, then, will be a “lowball” offer in some way, to minimize the risk for Opendoor. Again, the homeowner doesn’t have to accept that lowball offer; s/he can just go the traditional route and list the home with a broker.

Once it has bought the house, I’d imagine Opendoor would just turn right around and sell the house for whatever it paid plus a markup to a buyer, once again leveraging its financial resources to make that easy and painless as well.

That was the first impression, and it fits in with Greg’s take above. By June, I started thinking that Opendoor really just wants to create a market-maker model of real estate, and did some rough math to show that the company makes more in profits with that model than with the traditional splits-with-the-agent model. Basically, I compared what a brokerage that looked more like a car dealership would look like.

In February of this year, I speculated about what the impact of automation of property values by Fannie and Freddie could be. I did have Opendoor in the back of my mind then, but didn’t mention them by name. Here’s what I wrote then:

Fact is, the real power in real estate is in the mortgage banks. We’ve seen this firsthand when the housing market all but collapsed for a few years. We still see it when NAR, Realogy, big companies everywhere are constantly grousing about unavailability of capital to borrowers. Sure, a few rich people buy in all cash. Most investors do as well. But for the vast majority of buyers, if they can’t get a loan, they’re not buying a house.

All of the gyrations of the real estate industry in data analysis, all the talk of real estate Big Data, etc. don’t matter much if the bank says Nyet.

And then a bit further down:

Buyer clicks “Purchase Home”, and the machinery of contract, closing, etc. go into action. And please let’s not pretend that the actual process of going from contract to close is something that requires the average REALTOR. If there’s been significant automation in real estate technology in the past several years, it’s in making the paperwork more efficient. Digital signatures, online forms, offshore transaction coordinators, title and escrow companies, etc. etc. are all kind of a machine that can run itself.

But what about negotiation? That’s precisely the thing. If the bank tells you what mortgage it will write on a property, how much “negotiation” is there really to be had? Is that something a buyer and seller cannot do themselves?

To be honest, I was still missing a piece. I felt like there was something I was overlooking, but it took some research into the mortgage space for that last piece to fall into place.

Market Maker and Mortgage

The piece I was missing was the relative size of the real estate market and the mortgage market. I wish I had better statistics and figures than what follows, but I actually have to do some work 🙂 so if you have more accurate figures, I’d welcome them. (Who knows? Maybe I’m wrong.)

As best as I can figure with rough calculations, with median home price of $232,000 and annualized existing homes sales of about 5.6 million, real estate brokerage should generate about $71.5 billion in commission income in 2016 (based on 5.5% average commission rate). Large number, but of course, broker profits are something far less than that due to agent splits.

Mortgage… well, we know that banks make money primarily from interest payments. This article from American Banker bemoaned the fact that mortgages are the least profitable product for banks:

In my analysis, I have grouped together the 500 U.S. banks with the most residential mortgages relative to their total loans, and compared those institutions to other peer groups and to the industry as a whole. While the nation’s roughly 6,000 banks had a median return on equity of 7.82% through the third quarter of last year, our peer group’s median ROE was only 3.5%. Meanwhile, the peer group of banks with the lowest ratio of residential loans to total loans had a median ROE of 9%.

In addition, the median U.S. bank generated 55 cents of net income for every dollar paid in salary and benefits last year. But the 500 banks with the most mortgage loans had a median ratio of net income to salary and benefits of only 31 cents. Banks with the least commitment to a mortgage business had a ratio more than twice as high, at 70 cents.

Nonetheless, the bemoaning writer above is still talking about 31 cents of net income (not revenue, not company dollar, but profits) to a dollar of salary and benefits.

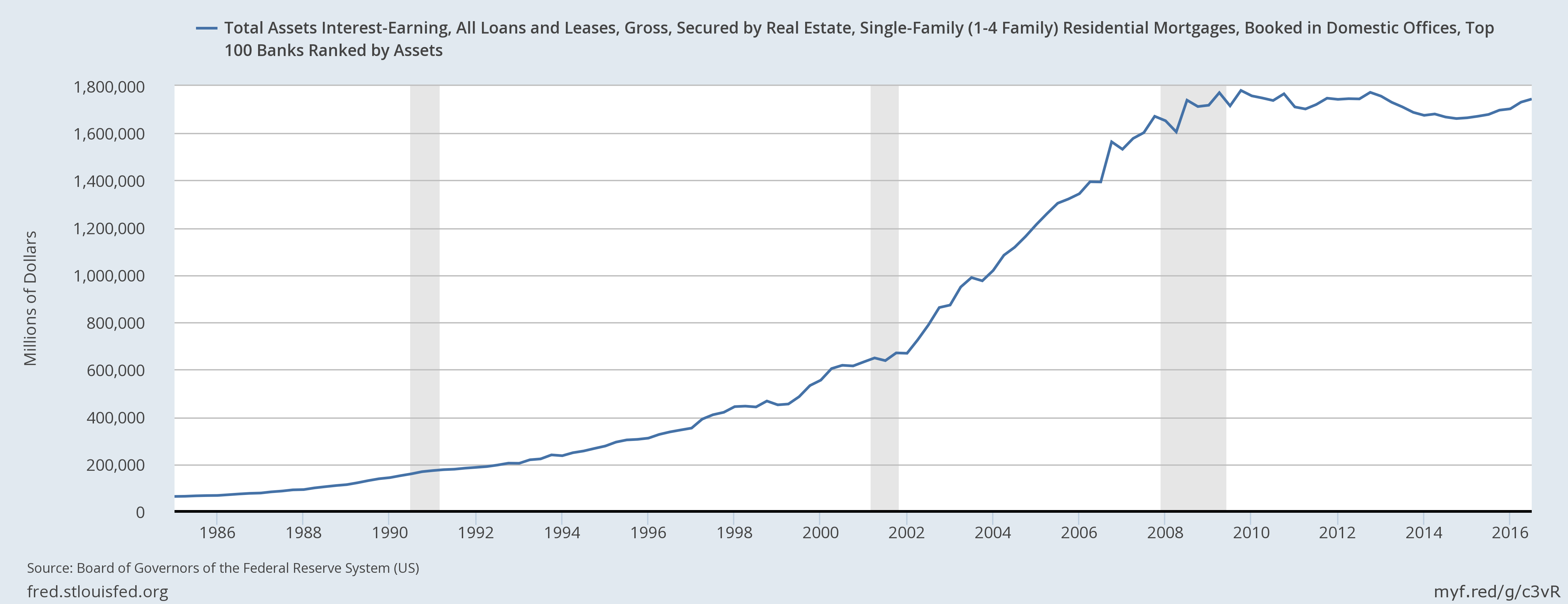

And according to St. Louis Fed, in 2016, the top 100 banks held $1,744 trillion in “interest-earning, all loans and leases, gross, secured by real estate, single family residential mortgages”:

I have no idea whether the 3.5% ROE figure above is just from mortgages or the total equity of the banks the writer is talking about, but let’s just say that 3.5% of $1,744 trillion is $61 trillion.

Like I said, I wish I had better numbers but… we could also just go look at the global headquarters of say Realogy and then look at the global HQ of Bank of America? Point is, real estate brokerage is big business, but mortgage banking is in a different class altogether. Let’s face it: the government didn’t go into a panic about global financial meltdown because some real estate brokerages were going to go belly-up, but because a few banks did.

Opendoor, I think, is aiming at a piece of that market rather than the few billion dollars in commission income from real estate brokerage.

And that fits in with Opendoor’s attitude towards the industry: so far, it has been relatively happy to work with brokers and agents, pay cooperating compensation, partner up with them, etc. etc. That makes sense if Opendoor has much, much, MUCH bigger fish to fry than some real estate agents.

Plus, Mortgage Is Painful

The final observation here is that while buying and selling houses is painful — and Opendoor does want to make that process easier with all of its innovations — the real pain as of today is the financing process. Honestly, compared to trying to get and close a mortgage, the house-hunting process is a joyful jaunt through a shady park on a clear fall day.

Teke touches on the possibilities in his article:

The payoff of this arrangement for both Opendoor and its financier might prompt more non-bank financial firms — such as private-equity companies and hedge funds — to wade further into the mortgage space.

Such companies have already been increasingly funding mortgages through online lenders and real estate crowdfunders.

Buyers might be able to more easily qualify and close on such mortgages than traditional home loans. Opendoor’s growth could catalyze acceleration in this arena.

I don’t think you can go raise $720 million in equity and debt for a two-year old startup without this being a specific part of the plan. Since I’m not privy to those plans, all I can speculate on is some combination of the following words:

- Seller-financing, by a well-capitalized “market maker”

- Private-label RMBS, at above market rates, which avoids the whole “conforming loan” business and all of the regulations that surround that

- Private mortgage insurance

Given the parlous fiscal state of the federales, and the announced intent by every Administration since W’s to reduce taxpayer involvement in the mortgage markets, do we really think we’ll see a lot of people saying that’s a terrible idea?

Now, imagine walking into a house, with your buyer agent by the way, liking it, then putting in an offer to have Opendoor say, “If you have a job, we’ll finance your purchase and close it within 48 hours!” The paperwork would be going to Opendoor.com and putting in some basic info and giving Opendoor access to your bank accounts. (Quicken Loans already does most of this with Rocket Mortgage, by the way….)

The alternative is to save 1.5% to go through the financial proctology exam that your traditional Fannie/Freddie/FHA/VA lender would put you through… with no guarantee that the loan would actually close 90 days out… depending on the appraisal… and a hundred other unknowns of whatever underwriting standards are in place at the lender.

Which would you choose?

That’s right. Now say it with me: CHA. CHING.

I could be wrong, of course, but… really, really smart people at venture funds and hedge funds and private equity funds put $720 million into Opendoor. Maybe it’s for a piece of the $71 billion in commissions. Maybe.

I’m betting that it’s for a piece of the $61 trillion (number not guaranteed to be correct) profits of the banks from residential mortgages.

See the Forest

So to my broker and agent friends, I’d like to say… relax. If Opendoor is successful, there are other problems to worry about, but unless I’m dead wrong (not out of the realm of possibility) I don’t think Opendoor is looking to screw you guys over.

Now, if I were a mortgage broker… that’s a different story altogether….

Gotta run, but we’ll talk more about Opendoor in the weeks and months to come.

-rsh

17 thoughts on “Forest for the Trees: Opendoor Edition”

Rob do you see them selling this “48 hour loan” on the secondary market? I like a lot where your thinking leads but there has to be a route for them to recapitalize or this money would get chewed up fast. Unless it is a simple loan that “anyone” could do then it will pretty easy to sell on secondary but that doesn’t unlock the others. I would love your thoughts on that piece.

Keith – I do. Most mortgages are GSE-insured, which gives assurances to RMBS investors. But private label RMBS exists:

“PLS issuance averaged US$368.7bn per year from 2001-07 but only averaged US$9.6bn per year from2008-14.” http://www.sifma.org/blog/us-private-label-mbs-market-2015/

I kinda get the feeling that the investors who were snapping up $368.7bn a year during the boom years wouldn’t mind getting in on that action. If Opendoor could just double the PLS market from about $10bn to $20bn, think of the money they would make, and more importantly, the massive capital infusion that would come in to replace their “war chest”.

I don’t know what they’re planning, but if I were them, I’d have setup private label RMBS partners on Wall Street, with private mortgage insurance (not GSE), to securitize the “institutional seller-financing mortgages” that they’re about to generate by the billions.

The one advantage that I think Opendoor would have is that they’re more than happy to foreclose on a property. Typical banks don’t want to, because they really don’t have a way of disposing of the REO property easily. Opendoor presumably wouldn’t have that problem since their whole platform is to buy-and-sell houses.

Any broker that has (not sure what the mortgage arrangement looks like today) experienced an MSA (Marketing Service Agreement), Joint Venture or actually have their own mortgage operation has realized this large profit center.

Back in the day, we went from a MSA to Joint Venture with Countywide. Our little 10 person brokerage produced a $60,000 profit in month one of the JV….a much easier deal than chasing commissions. So, it would not be surprising if you’re right and Opendoor is a mortgage play.

Are they a bank? Maybe becoming one? Either way, IMHO, their value proposition should sound good to many home sellers. If they are pursuing the financing business they would probably “cherry-pick” the properties that would qualify for their mortgage business operation and do their best to purchase less desirable assets well below market value and try to get out of them fast, unless of course they plan to be landlords….which works as well.

The hard part? Knowing the market(s). In my experience in order to truly evaluate value the buyer must have someone on the ground that totally understands the specific market in which they are buying…..that can be expensive i.e. employees, partnerships etc. As much as I like the computer, I wouldn’t think anyone would be putting real money behind some algorithm valuation result….it does not work. That said (insert marketing message), the most likely property type to go “full Internet” will be property / land, at least the structure can be eliminated from the formula (What’s that smell?, Is that mold? etc. etc.)

If they can figure out the “troops on the ground” part…..then they win! They seem to have found a way to overcome the most difficult part already…..the money 🙂

Good luck to Opendoor!

Brian

Good points, Brian.

Keep in mind that Opendoor does have a human appraisal element in their buying process. I get the feeling their approach — and it’s a valid one — is something like this:

– AVM error rates are single-digit (Zestimate’s median error rate is 4.5%, and you might read this: http://progressinlending.com/2014/02/11/avms-what-you-dont-know-can-cost-you/)

– In fact, the article linked above says AVM is *more accurate* than a traditional appraisal

– So if I offer to buy 5% less than what the AVM tells me, it’s unlikely that I’ll lose *that* much money.

– For a family homeowner, 5% is a Big Deal ($10K on a $200K house), and our industry is used to thinking in those terms. But for an institution like Opendoor, it really isn’t that big a thing, especially since they’re charging fees to cover themselves.

– If they buy 3,000 houses and sell 3,000 houses, on some they’ll lose money, while on others, they’ll make some money because the AVM isn’t 100% accurate. Over the entire portfolio, it’ll balance out, at least if they have some smart portfolio theory guys working there, and I’m sure they do.

– The “boots on the ground” thing is simple: Opendoor wants to work with real estate brokers and agents. They’ve always paid cooperating compensation; I suspect they’ll continue to do so, because they’re not in the business of helping buyers find houses. They’re in the business of buying and selling houses.

– What they’re probably NOT going to do is use listing agents, unless those agents are 100% comfortable using Opendoor’s platforms, processes, methods, etc. etc. including things like keyless entry that isn’t a lockbox. (Part of that may have to do with the W2/1099 thing we’re dealing with in the industry.)

– The real money, as I said, is in mortgages. If Opendoor can perfect that model, end-to-end, from seller-financing to mortgage servicing (contract with one of many providers) to private label RMBS… that’s a real game changer.

Now that you mention it, BROKERS might have reason to worry about Opendoor since many of them have affiliate arrangements on the mortgage front….

ROB:

I can’t count how many time I’ve told a seller “then you should sell it to the appraiser”

Appraisals, the bank said they’ll finance $X, AVM error rates….personally, I don’t think those points are strong enough to build a business around….but hey, I’ve been wrong many time before.

I’d just bite the bullet and become a bank….

Uh oh!

Rob, I think you’re on to something. Opendoor as market maker also provides a far more efficient selling mechanism for institutional landlords who need to divest individual properties from their portfolios in shorter timeframes. Wall Street makes money all over the place, ergo, you are most probably correct.

So it’s not CarMax, it’s the “Buy here, pay here” car lot. They make most of their money on the financing.

Why wouldn’t Realogy, KW, ReMax, et al either add this feature or create a sub-brand to do it? They’ve got boots on the ground and (relatively) easy access to capital markets.

Robert D.

As we are learning in other arenas, the “establishment” does not back real change. The names you mention are pro status quo, their model is ingrained in the(ir) system.

But, IMO, we’re getting closer. This progress would move faster if we saw some individuals within the establishment make a move to an upstart. IMO, one of the key missing pieces with the newbies is their lack of experience IN the business.

An old Jack Welch story tells it best: While visiting a GE plant that was having problems he spoke to the employees of the factory discussing what was going wrong. An old guy raises his hand and suggests to Mr. Welch that he should ask him and his co-workers why the business was faltering. The man told Jack “I’ve been here 40 years, I know everything about this plant, what works and what doesn’t….but no one has ever asked me – would you like to know?”.

I don’t often look at what competitors are doing…but IMO the establishment will start worrying when a senior manager with hands-on brokerage experience is asked to run the show….or at least brought on to help out 🙂

The only way to know a real estate market is to work or live in it. Without that, the risk line raises much faster than the rewards’ 🙂

Thanks,

Brian

Dude, if I were Richard Smith, I’d be looking to see if there’s ANY way I could raise the billions and billions of dollars to buy Opendoor. But looking at the folks involved in Opendoor, they aint’ selling. If they’re really sitting on top of something that could revolutionize a *quadrillion* dollar industry….

The other reason the established players tend not to do stuff like this is what Brian said. The status quo works for them beautifully. Why mess with it? I don’t agree with that line of thinking, but it is a prevalent theme.

Oh yeah, critical thing.

The “buy here, pay here” doesn’t work in real estate when you have a fiduciary duty to the buyer and/or to the seller. It only works with seller-financing type models because then you’re risking only your own property and your own money, and you’re not representing the buyer’s interests.

So for Realogy, KW, Remax, HomeServices or others to try and do this model, they have to get in the house-buying business, and prohibit their own agents from representing buyers on those properties. Tough to make work in the current model of real estate.

One more thing… (RQD, you’re really firing me up today)…

I don’t know, because I don’t know that world, but if you do… please comment.

If I’m a homebuilder, why wouldn’t I want to sell to Opendoor and let Opendoor take on the hassle of finding a retail buyer? Seriously. If I can build 100 homes for say $100K each, then sell *all of them* to Opendoor for $180K apiece even if the “retail value” of each home is $200K according to the AVM… why wouldn’t I want to do that, so I can immediately start building more homes and pay back my building loans and whatnot? Save on overhead, paying real estate agents, uncertainty of closings, blah blah blah — just let Opendoor deal with all of that, and let me get back to building more homes.

Why is this a bad thing if you’re a new home builder?

Let’s not forget what appears to be their core value proposition (I think): buy fairly, quickly and with cash. If that’s the case, this main attribute would have less value in the top-tier markets….”cash and quick close” are par for the course (especially with builders) in that market segment and that’s where the low risk mortgage business thrives….”lending money to people that don’t need it”.

This leaves the low and middle tier markets as their advantage….this makes me think subprime, The Big Short and falling dominoes…

Cash me in!

Home builders have had their own title and mortgage companies for years. They bundle and sell the paper and move on to the next land purchase.

DR Horton is in the 40,000 units/year category, Pulte around 15,000, and Ryland around 10k. They do mortgages on somewhere between 40%-65% of their units.

Smaller builders might look at it but everything new seems to be selling just fine…for the moment.

The entire RE industry needs to get rid of the “establishment”,nar the lousy MLS and their parasites the local boards,but most important are the GSE’s the mortgage biz has to be privatized Freddie and Fannie have to go the sooner the better there is no reason why a loan can not be realized in 48 hours,it’s the stupid people that run these places,the private sector is always better.

Exactly how would the mortgage biz in your “the mortgage biz has to be privatized” scenario look?

Comments are closed.