I think I need some help. [Ed: You’re just now realizing this? Really?] Something’s not really adding up for me as I think about the 2016 housing market forecasts. Economists, including one that looks a lot like me, are forecasting sort of modest growth for housing this year, based on 2015 being a great year. If so, why doesn’t it feel that way? Is it because I’m into doom-porn a la Zerohedge? Probably….

But go on this journey with me and tell me what I’m missing here.

2015 Rocked, and 2016 Will Be Good

Let’s start with an established respected voice of the real estate establishment, Lawrence Yun, Chief Economist of NAR:

The thesis here is that there is a huge amount of underserved demand, because builders have not kept up over the years, mortgage rates are still low by historical standards, and we’re seeing sustained job growth. OK, that all sounds pretty good. Other economists are also similarly upbeat. Take a look at this newsletter from RealtyTrac where six economists sound off on their projections for the housing market.

Jonathan Smoke, Chief Economist, Realtor.com:

Demand for for-sale housing will grow and will continue to be dominated by older millennials, aged 25 to 34. This demographic has the potential to claim a third of home sales in 2016 and represent 2 million home purchases.

Matthew Gardner, Chief Economist, Windermere Real Estate:

I expect that we will see more homes for sale. Homeowner equity started to recover in 2013 and has been steadily improving since that time. As such, I expect that it will increase their likelihood of selling.

Peter Muoio, Chief Economist, Auction.com:

Wage growth will be the key new ingredient for the housing recovery. We have been watching signs of accelerating wage growth percolate through different data sources but 2016 will see clear and convincing evidence of rising wages. This will help with housing affordability and be the final ingredient for higher household formations and housing demand.

Then you do have a bit of the bearish:

Douglas G. Duncan, Chief Economist, Fannie Mae:

Lots of discussion of the need for subsidy but the real problem is lack of income growth for low and moderate income households.

All of this should be reassuring, but… I’m not reassured. At all. I’m nervous as a German fraulein on New Year’s Eve in Cologne.

It All Began With…

Honestly, I wasn’t thinking about the housing market. Because I’ve been thinking about the real estate industry lurching towards Gehenna on its own. But then this guest op/ed from CNBC caught my eye, titled A Recession Worse Than 2008 Is Coming. What the hell? So I read through it. The basic thesis is that China’s economy is imploding, which pretty much wipes out global economic growth, which puts pressure on major companies, which in turn puts pressure on their employees and suppliers, and so on and so forth.

But then, I run across this:

Therefore, expect more stress on multinational corporate earnings as global growth continues to slow. But the debt debacle in China is not the primary catalyst for the next recession in the United States. It is the fact that equity prices and real estate values can no longer be supported by incomes and GDP. And now that the Federal Reserve‘s quantitative easing and zero interest-rate policy have ended, these asset prices are succumbing to the gravitational forces of deflation. The median home price to income ratio is currently 4.1; whereas the average ratio is just 2.6.

Therefore, despite record low mortgage rates, first-time homebuyers can no longer afford to make the down payment. And without first-time home buyers, existing home owners can’t move up. [Emphasis mine]

Oh crap. So basically, the increase in home values which pulled millions of homeowners out from being underwater on their mortgages was just financial engineering by the Fed? And now that those measures have to be unwound, home prices are going to have to go back down? (What goes up….)

I asked the new Chief Economist of Zillow, Svenja Gudell, about the quote above and this is what I received back:

Affordability is certainly an issue, especially this year. We don’t think that, nationally, we’re anywhere near a housing bubble. We’re carefully watching individual housing markets that are very hot, but even those markets are starting to cool off. It’s true that the price-to-income ratio is much higher than it has been historically, but that’s largely driven by low interest rates. It’s important to look at affordability, which takes mortgage rates into consideration and judges buying power and not just the price-to-income ratio.

First-time home-buyers are facing several hurdles as they make the transition from renters to homebuyers. Many are having a tough time coming up with a down-payment because of high rents and others cannot qualify for a mortgage. In our view, though, one of the biggest hurdles for first-time homebuyers is that there are very few homes, especially entry level homes, on the market to buy. [Emphasis mine]

So kind of a 50/50 response that could support the views of Michael Pentos, the CNBC doomsayer (price-to-income very high, and manufactured by cheap money policy of the Fed) or the industry happy-faces (we’re nowhere near a bubble), etc.

I sought further clarification, because the one thing I do think is relevant is whether we really are near the 4.1 price-to-income that Pentos brought up. Here’s Svenja’s answer:

Historically, the US price-to-income ratio has been around 2.8. At it’s peak it was at 4.1 and currently (2015 Q3) it’s at 3.3. We have a nice visual here: http://www.zillow.com/research/q3-2015-mortgage-rent-affordability-11197/ (the orange line in the second graphic). The reason we aren’t currently worried about a housing bubble is that mortgage rates are at historical lows and buyers’ purchasing power has increased with this slower rates. So despite the price-to-income ratio being higher than historically normal, buyers feel like they can afford quite a bit more than they have been able to in the past. To measure this, we use mortgage affordability, which Is denoted by the blue line. Even if incomes stay where they currently are and home values increase and mortgage rates increase, buyers will still spend less on a mortgage payment than they are historically used to.

OK, whew, right? Not so fast, because I clicked through to that report/visual (you should read it in full) and get this:

What’s more, rising rents and fairly flat income growth are making it hard to save for a down payment in the first place. The share of income needed to afford median rents rose in 28 of the 35 largest U.S. metros over the past year. In other words, renters’ money that could be going into the piggy bank for a future down payment is instead going into landlords’ pockets.

As a result, first-time homebuyers and millennials, in particular, are left trying to find other ways to come up with a down payment in order to break into the housing market, often turning to friends and family for financial help. In 2014, 13 percent of home purchases were bought with help from a loan or gift from friends or family as part of the down payment.

…

And on top of it all, down payment amounts themselves are a rapidly moving target – the amount needed for a healthy down payment keeps rising.

Um, that’s precisely Michael Pentos’s thesis: first time homebuyers can no longer afford to make the down payment, because home prices have ballooned too high relative to income. The Fed created that mess with its cheap money policies.

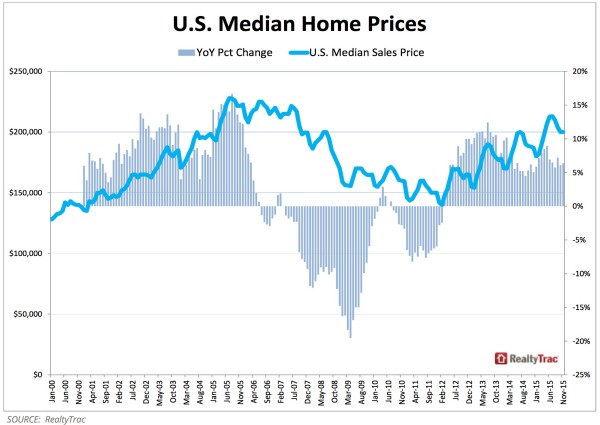

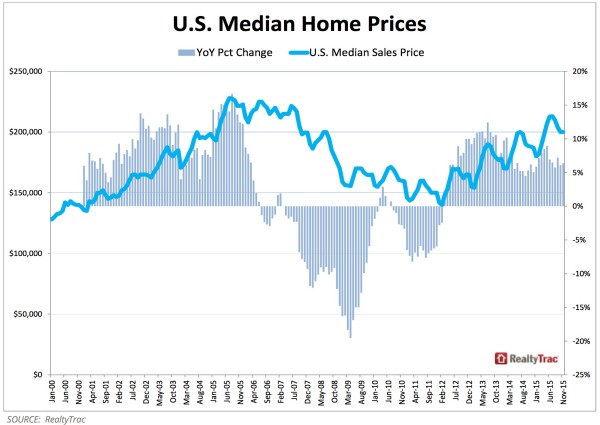

Then I see this chart from RealtyTrac:

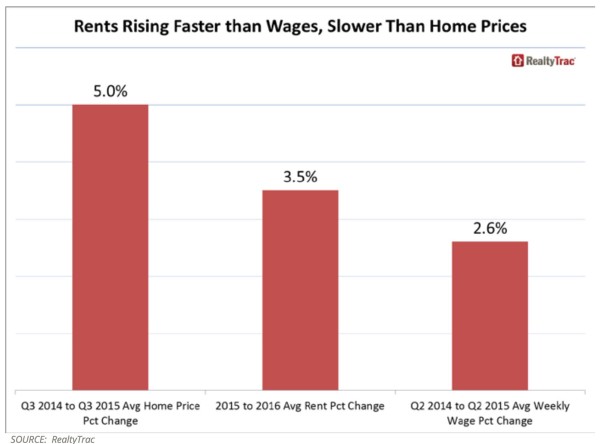

Do my eyes deceive me or is that graph suggesting that the median home price is very close to the peak of the housing bubble in 2005? And home prices have in fact risen faster than either rents or incomes:

So home prices have risen at double the pace that wages have risen? Uh oh.

Global Economic Activity…

The nervousness continues with the scariest thing I’ve read in a while, about an obscure metric that basically nobody pays attention to: the Baltic Dry Index. It’s a blogpost, but the quality is such that it rises far above a typical pajama-clad blogger fare. Check it out in full.

Basically, the Baltic Dry Index tracks the price of shipping stuff from one place to another via oceangoing ships. Higher BDI means higher prices, which implies that shipping companies are busy with orders, and can charge more money for space on their ships (which is, after all, finite). Lower BDI means lower prices, which implies that shipping companies have empty space on their ships, and would rather sell that space and fill the cargo before sailing across the ocean.

The BDI hit a record low on January 12th of 402, and one of the sites that the post above links to (Hellenic Shipping News) contains this fun paragraph:

The Baltic Dry Index measures change in transportation costs of raw materials such as metals, ore, coal, grain and fertilisers by sea. The index has been on a continuous fall since August following China’s economic data which actually set the strong bearish tone for the bulk trade market not just in the Asia Pacific region but across the globe. China being the world’s largest importer and exporter of several commodities, a slowdown in its economy indicates grim trade climate across world.

Lower BDI means there is less production going on — the typical consumers doesn’t need iron ore, coal, and metals. Those are factories that make stuff that need those things. If they’re not making as much stuff, then obviously, they need less of the raw materials. But why wouldn’t factories all around the world, but primarily in China, be making as much stuff… unless the people who might buy them at retailers aren’t… buying as much stuff….

In light of that, this news seems ominous: Walmart Closing 154 Stores in the U.S. Just from that closing, 10,000 U.S. workers are going to lose their jobs. But here in my home city of Houston, we’ve been dealing with the fallout from low oil and gas prices for a couple of years, with layoffs being announced all the time.

Let me suggest that it’s awful hard to think you’re in a seller’s market if your neighbors are losing their jobs.

Finally…

The most worrisome thing about all these subterranean rumblings like the BDI and production slowdowns and all that is… it’s not clear that there’s anything that anybody can do about it.

When the housing bubble collapsed in 2007/2008, and the Great Recession began, the government bailed out the big banks, and the Fed slashed rates to zero to try and spur economic activity. All the other stuff, quantitative easing, first time buyer tax credits, and so on, all kinda sorta patched together a kinda sorta solution to bring the market out from the depths of despair.

But what can they do this time around? As Michael Pentos points out, there really isn’t anything the government can do:

First, the Fed will not be able to lower interest rates and provide any debt-service relief for the economy. In the wake of the Great Recession, former Fed Chair Ben Bernanke took the overnight interbank lending rate down to zero percent from 5.25 percent and printed $3.7 trillion. The Fed bought longer-term debt in order to push mortgages and nearly every other form of debt to record lows.

The best the Fed can do now is to take away its 0.25 percent rate hike made in December.

Second, the federal government increased the amount of publicly-traded debt by $8.5 trillion (an increase of 170 percent), and ran $1.5 trillion deficits to try to boost consumption through transfer payments. Another such ramp up in deficits and debt, which are a normal function of recessions after revenue collapses, would cause an interest-rate spike that would turn this next recession into a devastating depression.

Holy *#&@(*%!

Seeing as how we’re at 3.3 price to income today (according to Svenja from Zillow), and the longterm average is more like 2.8 price to income, and it doesn’t look like income is going up… and the government is more or less out of options to engineer a way out of the next economic downturn… doesn’t all that imply that housing is something like 20-30% overvalued?

Help me. Talk me off the ledge, y’all.

And… while you’re at it, please explain this graph again and tell me why we’re not in a housing bubble:

-rsh

14 thoughts on “Why Am I Nervous About the 2016 Housing Market?”

Rob, I love your blog and this was one to comment on. Since 2007, I’ve been studying residential real estate: the practice, the industry and the economy. I found your blog back then. Regardless, the ledge is real, but you don’t have to be on it. Just keep paying attention to the facts, not spin, because: learn better; know better; win.

You can only teach those who want to be taught, right? I no longer try to explain to brokers / agents about things they simply don’t want to know, are afraid to hear or they think it will hurt their revenue. The opposite is true in fact, but I won’t get into how backward (i.e. counter-intuitive) most broker / agent business practices are.

My links below aren’t clickbait to get views, I could care less. I’m just citing the source w/ timestamps. They support what your post is about. I wanted to share that many out here aren’t rainbows and unicorns nor doom and gloom, but just realistic about our lives, money and futures related to housing. This stuff effects far too many people to keep doing things the same way!

Oct 2014

My tweet: “#fyi #CBus local housing market is crazy imbalanced. 2014-15 sell your home primetime; overpriced due to demand ONLY. Won’t last #ColumbusOH”

https://twitter.com/HomeandOwner/status/525280232665006080

2014 real estate stats gave a clear clue to 2015. By October, with 2014 nearly over and definitely leading into 2015, it was clearly peak price and selling time. Well … look what happened in 2015 = major peak! Learning to read the stats will tell you 80% of all you need to know. I’ve spent thousands of hours reading them over the years.

August 2015

“The severity of the correction will depend on factors outside of housing: investors, income, recession, jobs, etc. versus the quality of loans which are good.” It’s longer, more in-depth, but I wrote that August of last year about 2016 and beyond. https://homeandowner.wordpress.com/2015/08/24/columbus-ohio-housing-aug-2015-future/

Let me be clear: Housing prices are propped up only due to supply and demand (econ 101). It’s that simple right now, then everyone can add all the other reasons why. It will correct, but after 2016. Lower profits, leading to layoffs, into a recession is the one we should be most worried about, but with bad comes good (i.e. balance).

Predicting the real estate market, once you ignore the incentive to push sales, isn’t that hard, because it’s super slow to change. Now if I could only find people in the industry that aren’t afraid of this stuff.

Great analysis! Basically, the same stuff I’ve been wondering about. Things just don’t quite add up, do they?

Rob, since I run a market analytics company, it’s with great interest that I read your treatice. This is incredibly well-written, reasoned and supported by the most solid of solid economic facts. Nice work. The only addition I could possibly make was to remind everybody that all real estate is local. And even more obviously, hyper local. So while these top down trends are inevitable, there are countless other permutations that can arise at the local level as buyers and sellers make decisions in 2016. One thing we know for sure is even with the Fed doing with the Fed’s going to do, the real impact on mortgage rates is negligible. To me it’s as the Great American philosopher, Yogi Berra, would say: it’s 90% mental and the other half physical. As market economists and observers, I don’t think we spent enough time focusing on the psychological impact, rather than the statistical. And like it or not, real estate is very much a psychologically, ego-driven initiative that consumers undertake. So, bravo to you for a very interesting and engaging read on this uber-snowy Saturday afternoon. Hope to see you next week at Inman and safe travels my friend!

This one’s simple. Anyone in the industry forecasting about the industry should be suspect. Especially the NAR where “sugar pops dance in their heads” everyday. How else would you be able to lure more members into the game? Come on in and play in a shrinking market? Nope. Organized real estate has lost all credibility with anyone who actually depends on the opinion. That’s why Zillow was invited a few years ago to the White House for the housing forum and not the guys from Chicago at the NAR. No need to stand on a ledge Rob unless your world is based in the opinion of those that possess “semi-clouded crystal balls”. The only thing for sure is the housing market will happen.

The RE business is in trouble, we have almost no manufacturing jobs left in the US , they are firing in the oil patch , so whats left, low paying jobs in fast food,retail sales,etc. and these are declining, (Walmart ) is it any wonder that the RE market is in trouble,in my market Northern Va, sales(2015) in the million $ market slowed to a crawl ,but the nonsense that comes from the “giants of the industry” nar, the mls’s and their buddies at the WH, is mind boggling, there is a crash near, some in the RE business will do very well but it will be a much smaller market, and we will have to climb over a lot of dead bodies to survive.

Rob, I posted this link in a Facebook comment on your article. https://www.youtube.com/watch?v=IFh752I7U-I

don’t trust Yun, mostly because as a real estate economist he lacks the chutzpah to ever scream “stop” or “help” or “run for your lives.” His job is to tone down the ups and downs of our financial condition, tender some talking points for NAR, and then safely go back home away from the actual reality that real estate agents and homeowners still struggling from this economy face.

I hope everyone will watch the link and decide for yourselves whether you think the Federal Reserve hasn’t led us to the brink of a real disaster (and I’m calling the last price drop and recession as simply a disaster….not a real one. I lived during the real recession of the 1960’s, and this last falling out didn’t hurt nearly as bad as that one.)

I believe now that we’ve waltzed into a debt that our mantra’s of a “Great country with unlimited resources” won’t dance.

Your well thought out article is truly cause for concern, for everyone on the planet, especially since in our profession of real estate we are intimately more connected to value and loss than most other professions.

Rob, good stuff. There are many different factors tugging at our market. Supper low interest rates have been masking what the lack of income growth should have done to the real estate market. That is just one factor. We are in a mutant market, stocks, real estate and more are not likely to follow past patterns. Keep your powder dry:-)

I am in agreement with most everyone else here, the numbers, sans the hype, do not support 2016 being better than 2015. No reason to pile on the stats, but I do think the swing vote in this will be the millennial activity. What I personally see day to day echoes the quotes in the article about the difficulty of getting financing and raising the down payment. The culture in this age group to rent for the sake of flexibility does little to encourage real estate as a long term life investment. Add on the usual youthful exuberance and carefree attitude that comes with being a young American in the last 70 years, some real barriers in lending in high cost urban areas, and I am doubtful the hoped for Millennial bump in sales is going to get us far.

2015 was also a year of many investor transactions, with the majority moving out of the market and re-positioning their dollars in multi unit rentals to better leverage the ROI.

NAR stats are solid, you just have to stay away from all the commentary and add in a small dose of pessimism when you are looking at forecast activity based on their Realtor Confidence Survey, which fuels that baseline for them.

Stop reading Yun’s opinions. He is just a “House Organ Piper”. Instead, seek the opinions of some experts that predicted the 2008 Crisis: Peter Schiff, Simon Black; Gerald Celente; Craig B. Hulet; Greg Hunter; David Stockman; Harry S. Dent; Alex Jones; Joel Skousen; Steve Quayle and Daniel Estulin.

You are betting on future demographics and they are terrible. Who’s going to buy the Baby-Boomer’s big houses? The Middle Class is disappearing along with home ownership. 62 People own the same wealth as half the world’s population. Are they going to own all the houses as rentals? Most of the new jobs are not “middle-class”. Can the Rich Chinese on EB-5 Visas keep the market afloat? When is Europe going to crash from the invasion? Think about it!

Rob, what type of comments plugin to you use on this wordpress site? I like how straight-forward it is.

No plugin 🙂 This is native WP comments.

I like it. Easy to read your comments and replies.

RSH~ one thing is for sure- something has to give. There are many factors that come into play- making it hard to really know which way things go. I recently watched a Harry Dent video- in the video, he makes some compelling predictions about the DOW crashing below 6000, and the housing market crashing 40 percent over the next couple of years. I am hoping he’s wrong, but I can see why he’s making theses bold predictions.

Whatever happens- it seems like the American people are at the mercy of our Governments policy, our economy, and the global economy. And even though our economy is barely doing ok, our Government policies and the global economy seems to be headed in the wrong direction. And between poor Government policies and a soon to be failed global economy- I fear the worst is ahead of us…

http://pro.dentresearch.com/DOW10/PBNBRA06?h=true

I’m afraid I can’t talk you off the ledge, because everything you said is dead on. All signs are pointing a full-blown recession right around the corner and even though the government seems to think they’re omnipotent, they’re not, and there’s nothing they can do to stop it. We’re just going to have to ride it out.

Comments are closed.