I’ve seen quite a few posts of late suggesting that the housing market has finally hit bottom. Agent friends of mine are telling me about increased activity in their local markets, multiple bids on houses, low inventory, and so on. We have Stan Humphries of Zillow saying the Spring 2012 season should be positive. And none other than Calculated Risk, hardly a cheerleader for housing, has called the bottom on housing:

And it now appears we can look for the bottom in prices. My guess is that nominal house prices, using the national repeat sales indexes and not seasonally adjusted, will bottom in March 2012.

…

There are several reasons I think that house prices are close to a bottom. First prices are close to normal looking at the price-to-rent ratio and real prices (especially if prices fall another 4% to 5% NSA between the November Case-Shiller report and the March report). Second the large decline in listed inventory means less downward pressure on house prices, and third, I think that several policy initiatives will lessen the pressure from distressed sales (the probable mortgage settlement, the HARP refinance program, and more).

I’m working on the Redfin 3.0 post, but this was interesting enough that I took a short break from that to run some quick numbers. Maybe all these green shoots of positivity will indeed result in the housing market finally turning around. For a variety of reasons, I’m skeptical of such a thing, but I could be and hope to be wrong.

What I wondered about is whether this increase in housing activity, increase in prices, were actually just a reflection of higher inflation and inflation expectations. Well, there might be a way to measure that…

Enter GOLD!

Gold, the Ultimate Holder of Value

My inspiration for this came from this post on Forbes about oil prices:

As this is written, West Texas Intermediate crude oil (WTI) is trading at $105.88/bbl. All this means is that the market value of a barrel of WTI is 105.88 times the market value of “the dollar”. It is also true that WTI is trading at €79.95/bbl, ¥8,439.69/barrel, and £67.13/bbl. In all of these cases, the market value of WTI is the same. What is different in each case is the value of the monetary unit (euros, yen, and British pounds, respectively) being used to calculate the ratio that expresses the price.

In terms of judging whether the price of WTI is high or low, here is the price that truly matters: 0.0602 ounces of gold per barrel (which can be written as Au0.0602/bbl). What this number means is that, right now, a barrel of WTI has the same market value as 0.0602 ounces of gold.

…

Over the centuries, gold has been “the golden constant”. Eventually, all prices equilibrate with gold. This is why gold represents the best available standard in terms of which to define the value of a monetary unit. Forty-one years ago, when the value of the dollar was defined in terms of gold at $35/oz, WTI was selling for $3.56/bbl.

What I wanted to do was the apply the same logic to housing.

Housing Prices, Since 1970

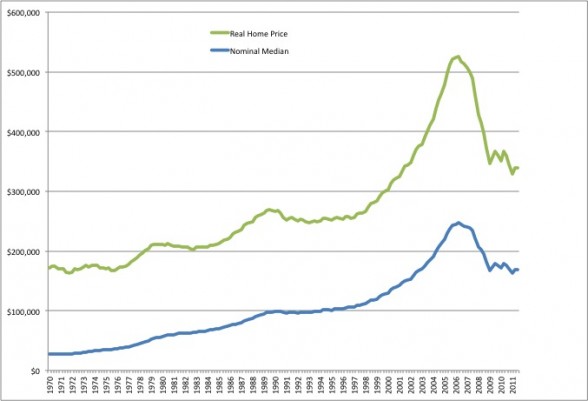

So I went and found some data on median housing prices from 1970 (when the median price of a single family house was $26,986) through Q3 of 2011 (when the median price was $169,500). Then I also found some data that figured out the Real Price, correcting for some inflation (CPI). What we have from that data is this:

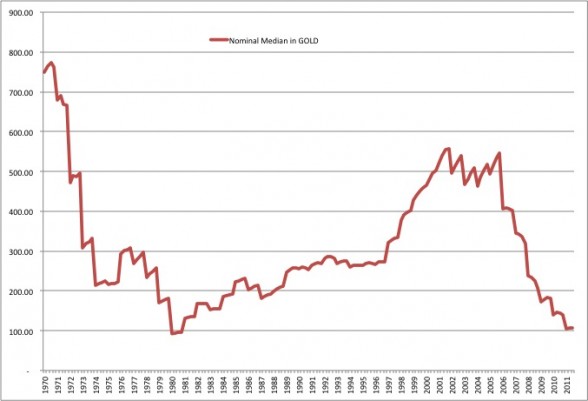

I then found gold prices in USD for the same period, and calculated how many ounces of gold one would have had to pay for the median priced home from 1970 to 2011. Here’s that graph:

Sort of different eh?

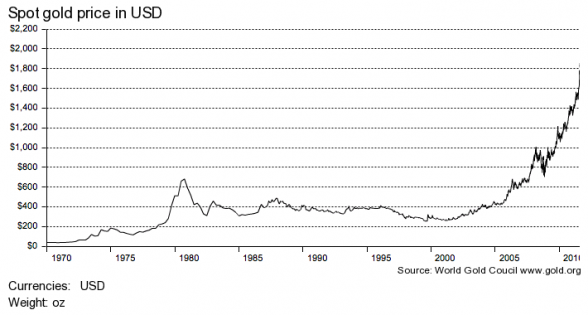

And a final graph — price of Gold in USD since 1970:

What About Since the Bubble Burst?

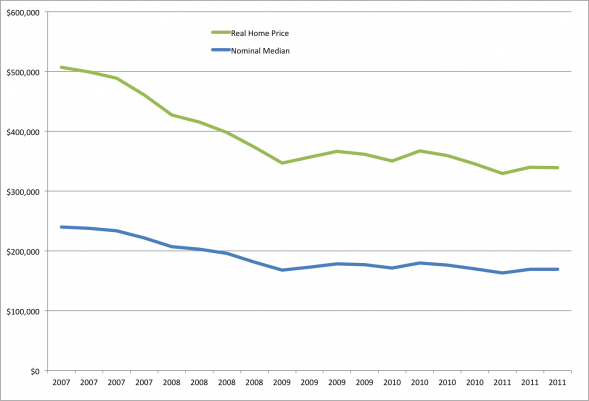

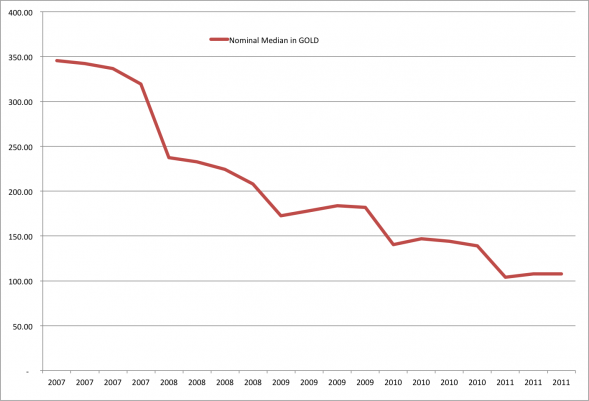

If we say that the Bubble burst in 2007 — although most people agree it started sometime in late 2006, or earlier, the price effects might not have shown up until 2007 — and we draw the above charts, they look like this:

Calling Dr. Yun

This is where I need someone far better at economics. I’ll take an amateur stab at what to make of this, but please, correct me as I’m sure to be wrong.

The most obvious thing is that if you price homes in gold, the home values in 2011 are almost at the lows of 1980. In 1980, the median priced home in the US cost 92.41 oz of gold; in 2011, the median priced home cost 103.84 oz of gold.

The second glaring thing is that if you price homes in gold, housing has taken a far bigger hit than we perhaps have realized until now. In 2007, when the Bubble burst, the median house cost 345.52 oz of gold; in 2011, the median house costs only 107.86 oz of gold. But the Real and Nominal price graphs, denominated in USD, are showing far smaller albeit still painful declines. The Real Price, adjusting for CPI, of the median priced house went from about $266K in 2007 to $167K in 2011.

But in gold terms, the loss was more than 2/3 of the value of the house. For the same price paid for one median priced home in 2007, the buyer in 2011 can purchase three median priced homes… and still have some gold left over. That is an astonishing loss of value.

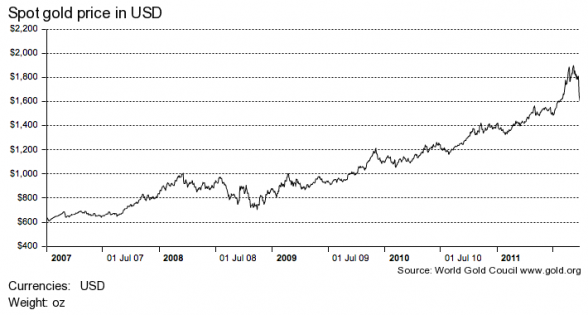

Third, strength of gold prices means the weakness of the dollar. It’s almost the textbook definition of currency devaluation. For housing prices to recover, the price gains would have to outpace the rise in gold prices… or gold prices must drop, which means that the dollar is getting stronger.

With another trillion-dollar-plus deficit in the 2012 budget, and some $16 trillion in national debt, it seems unlikely that we’d see a real rally in USD anytime soon. It isn’t clear to me that the Fed could turn off the printing presses now, even if it wanted to do so.

Finally, it may be that the “Real Price” of housing is seriously flawed in some way… or in the alternative, that gold is extremely overvalued right now. There are arguments on both sides: the CPI excludes some key measures, such as gasoline prices and the cost of food — the two things that most families spend a bunch of money on. But on the other hand, the extraordinary run-up of gold prices may simply be due to a bunch of speculators and gold bugs jumping in with both feet.

Takeaways?

Er, I don’t know. I’m not an economist, although I stayed at a Holiday Inn Express last night.

One possible conclusion is that at least in ounces of gold, prices are pretty close to the bottom reached in 1980. Part of it, again, could simply be that gold is overvalued… but if you believe that gold is the ultimate inflation hedge, you have to think that there is some reality behind the idea that housing prices have more or less hit bottom.

But the other conclusion is that if inflation expectations are high, remain high, or become high… then gold prices will continue to rise, which means that any gains in price of housing are offset by the loss in purchasing power of the dollar. It does a seller little good to sell a house at listing price, only to end up with a bunch of cash that can’t buy the same things it could a few years ago.

I don’t know… but the whole thing makes me super glad that I put down a very large chunk of cash to buy my house last year…. And were I forced to sell in today’s environment, I might ask for more than I thought possible, simple because the USD is losing value. On the flipside, now might not be the time to be bargain hunting as a buyer, since your cash is continuing to lose value. Unless, of course, you offer to pay in gold bullion at the closing. In which case you may end up making a golden deal or two.

Anyhow, just a quick little post while I’m working on my other one.

-rsh